The Employee Retirement Income Security Act (ERISA) establishes critical protections for millions of Americans enrolled in employer-sponsored health and welfare benefit plans. Yet many employers and employees remain uncertain about exactly which health plans fall under ERISA jurisdiction. Understanding whether your organization’s medical, dental, vision, or life insurance plans are subject to ERISA isn’t just a matter of regulatory compliance—it’s essential for protecting both your business and your employees’ healthcare security.

Enacted in 1974, ERISA established comprehensive standards for employer-sponsored benefit plans in the private sector. While initially focused on retirement benefits, ERISA’s scope expanded to encompass health and welfare plans, creating a complex web of compliance requirements that affect millions of American workers and their families.

According to recent Department of Labor statistics, ERISA currently protects the interests of approximately 152 million workers and their dependents in more than 2.4 million health and welfare plans nationwide. With such widespread impact and potential penalties for non-compliance reaching into the tens of thousands of dollars, knowing precisely which health and welfare plans are subject to ERISA has never been more important.

This comprehensive guide will walk you through exactly which health and welfare plans fall under ERISA jurisdiction, which organizations must comply, who enjoys exemption status, and what employers must do to maintain compliance with these critical federal benefit standards. Whether you’re an HR professional, business owner, or employee seeking to understand your rights regarding health benefits, this article provides the authoritative answers you need about ERISA coverage rules.

Who Is Subject to ERISA? Health and Welfare Plan Edition

Health and Welfare Plans Subject to ERISA

Employer-sponsored medical insurance plans

Dental and vision insurance plans

Prescription drug coverage

Health Flexible Spending Accounts (FSAs)

Health Reimbursement Arrangements (HRAs)

Group life insurance plans

Disability insurance (short-term and long-term)

Accidental death and dismemberment insurance

Employee Assistance Programs (EAPs) providing counseling benefits

Wellness programs with significant medical components

Health and Welfare Plans Exempt from ERISA

Government employee health plans (federal, state, local)

Church plans and religious organizations

Government-mandated insurance (state workers’ compensation, unemployment)

Employee benefit plans required by government contract

Retiree health plans without employer contributions

Health benefits under workers’ compensation laws

State-mandated benefits (e.g., temporary disability insurance)

Health benefits provided solely through insurance contracts

Plans maintained outside the employer’s jurisdiction (e.g., multi-state plans)

To determine if your specific health plan falls under ERISA, check if it’s employer-sponsored, involves ongoing administration, and provides welfare benefits to employees. When in doubt, consult with an ERISA specialist, as non-compliance penalties can be substantial.

What Is ERISA? Health and Welfare Plan Focus

The Employee Retirement Income Security Act of 1974, commonly known as ERISA, is a comprehensive federal law that establishes minimum standards for employer-sponsored benefit plans, including health and welfare plans. While ERISA was initially created to address issues with pension plans, it has evolved to provide significant protections for employees enrolled in various health and welfare benefit programs.

ERISA and Health & Welfare Plans

In the context of health and welfare benefits, ERISA governs a wide range of employer-sponsored plans that provide medical, surgical, hospital, and other care benefits. These plans form a critical part of the employee benefits landscape in the United States, providing essential coverage for millions of workers and their families.

ERISA defines “welfare plans” as programs established or maintained by an employer to provide participants or their beneficiaries with:

- Medical, surgical, or hospital care benefits

- Benefits in the event of sickness, accident, disability, or death

- Unemployment benefits

- Vacation benefits

- Apprenticeship or training programs

- Day care centers

- Scholarship funds

- Prepaid legal services

- Holiday and severance benefits

Of these, the health and medical benefits category represents the largest and most significant type of welfare plan regulated by ERISA.

Key ERISA Provisions for Health and Welfare Plans

For health and welfare plans, ERISA establishes several important requirements:

- Plan Documentation: Employers must maintain a written plan document that outlines the benefits, eligibility requirements, funding mechanisms, and claims procedures.

- Summary Plan Description (SPD): Plan administrators must provide participants with an easy-to-understand summary of the plan’s benefits and operations.

- Claims Procedures: Plans must establish reasonable procedures for filing benefit claims, notifying participants of claim denials, and appealing denied claims.

- Fiduciary Responsibilities: Those who manage health and welfare plans must act solely in the interest of plan participants and beneficiaries.

- Reporting Requirements: Plan administrators must file annual reports (Form 5500) with the Department of Labor for certain health and welfare plans.

Continuation Coverage: Through COBRA amendments, ERISA requires many group health plans to offer continuation coverage to participants who would otherwise lose coverage due to certain qualifying events.

ERISA Amendments Affecting Health Plans

Several important amendments have expanded ERISA’s protections for health plan participants:

- COBRA (1985): Provides temporary continuation of group health coverage that might otherwise be terminated

- HIPAA (1996): Protects workers from discrimination based on health status and improves portability of health coverage

- Newborns’ and Mothers’ Health Protection Act (1996): Sets minimum hospital stay requirements for mothers following childbirth

- Mental Health Parity Act (1996) and Mental Health Parity and Addiction Equity Act (2008): Requires parity between mental health/substance use disorder benefits and medical/surgical benefits

- Women’s Health and Cancer Rights Act (1998): Requires coverage for reconstructive surgery following mastectomies

- Affordable Care Act (2010): Added numerous patient protections and coverage requirements

Understanding these fundamental aspects of ERISA is essential for employers who offer health and welfare benefits and for employees who rely on these important protections.

What Is the Purpose of ERISA for Health and Welfare Plans?

The Employee Retirement Income Security Act serves a vital purpose in the realm of health and welfare benefits: protecting the interests of employees and their beneficiaries who depend on employer-sponsored health plans. While ERISA’s original focus in 1974 was primarily on retirement security, its scope has expanded significantly to address critical health benefit protections that millions of Americans rely on today.

Core Protective Functions for Health and Welfare Plans

ERISA fulfills several essential purposes in safeguarding employee health benefits:

- Ensuring Transparency and Disclosure: ERISA requires plan administrators to provide participants with clear, comprehensive information about their health coverage. This includes detailed Summary Plan Descriptions (SPDs) that explain coverage terms, limitations, and procedures in language ordinary participants can understand. This transparency helps employees make informed healthcare decisions and understand their rights.

- Establishing Fiduciary Standards: The law imposes strict fiduciary duties on those who manage health and welfare plans. These fiduciaries must act solely in the interest of plan participants and beneficiaries, making decisions that prioritize providing promised benefits rather than serving employer interests. This protection helps ensure that health plan assets and operations are managed responsibly.

- Creating Uniform Standards: ERISA establishes consistent national standards for health plan administration, replacing the patchwork of state regulations that previously existed. This uniformity helps multi-state employers administer plans efficiently while ensuring baseline protections for all covered employees.

- Providing Enforcement Mechanisms: The law gives participants the right to sue for benefits and breaches of fiduciary duty. This accountability mechanism helps ensure that plan administrators fulfill their obligations to process claims fairly and provide promised health benefits.

- Protecting Against Arbitrary Claim Denials: ERISA requires health plans to establish and maintain reasonable claims procedures, including timeframes for decisions and opportunities for appeal. These procedural protections help prevent arbitrary or capricious denial of health benefits.

Evolution of ERISA's Health and Welfare Plan Protections

ERISA’s protections for health and welfare plans have expanded significantly through important amendments:

- COBRA (1985): Ensures temporary continuation of health coverage after job loss, reduced hours, divorce, or certain other qualifying events, helping prevent gaps in medical coverage during life transitions.

- HIPAA (1996): Prohibits discrimination based on health status, limits pre-existing condition exclusions, and improves portability of health coverage when changing jobs, addressing key barriers to continuous health insurance coverage.

- Women’s Health and Cancer Rights Act (1998): Requires group health plans that cover mastectomies to also cover reconstructive surgery and related services, ensuring comprehensive care for breast cancer patients.

- Mental Health Parity Acts (1996 and 2008): Requires group health plans to provide mental health and substance use disorder benefits at parity with medical/surgical benefits, addressing historical inequities in behavioral health coverage.

- Newborns’ and Mothers’ Health Protection Act (1996): Sets minimum hospital stay requirements following childbirth, preventing dangerous “drive-through deliveries” that threatened maternal and infant health.

- Affordable Care Act (2010): Added numerous patient protections including coverage for preventive services without cost-sharing, elimination of lifetime and annual limits, and coverage for dependents until age 26.

By establishing these comprehensive protections, ERISA helps ensure that the health and welfare benefits promised to employees are actually delivered, creating a more stable foundation for healthcare access across the private sector workforce. The law continues to evolve to address emerging challenges in the healthcare landscape, maintaining its central purpose of protecting employees and their families who depend on employer-sponsored health benefits.

Who Is Subject to ERISA? Health and Welfare Plan Coverage

Understanding which employers and health benefit plans fall under ERISA jurisdiction is crucial for compliance and proper benefit administration. ERISA’s scope for health and welfare plans is broad but contains specific parameters that determine coverage.

Employers Subject to ERISA Health and Welfare Plan Requirements

ERISA applies to a wide range of employers in the private sector who offer health and welfare benefit plans to their employees:

- Private-Sector Employers: The most fundamental criterion for ERISA coverage is that the employer operates in the private sector. This includes:

- For-profit corporations of all sizes

- Limited liability companies (LLCs)

- Partnerships

- Sole proprietorships

- Private non-profit organizations

- Employers Offering Voluntary Health Benefits: Any private employer that voluntarily establishes or maintains employee health benefit plans falls under ERISA jurisdiction. This applies regardless of the company’s size—even small businesses with just a few employees are subject to ERISA if they offer qualifying health plans.

- Multi-Employer Health Plan Sponsors: Organizations that participate in multi-employer health benefit arrangements, such as those established through collective bargaining agreements, are subject to ERISA regulations.

Professional Employer Organizations (PEOs): When PEOs co-employ workers and offer health benefit plans, these arrangements typically fall under ERISA’s purview.

Health and Welfare Plans Subject to ERISA

ERISA covers a comprehensive range of health and welfare benefit plans, including:

- Medical Insurance Plans: Comprehensive health insurance covering doctor visits, hospitalizations, and other medical services

- Specialized Health Coverage:

- Dental insurance

- Vision insurance

- Prescription drug coverage

- Hearing benefits

- Health-Related Accounts and Arrangements:

- Health Flexible Spending Accounts (FSAs)

- Health Reimbursement Arrangements (HRAs)

- Some Health Savings Accounts (HSAs) with significant employer involvement

- Insurance and Protection Plans:

- Group life insurance

- Accidental death and dismemberment (AD&D) insurance

- Short-term disability insurance

- Long-term disability insurance

- Long-term care insurance

- Wellness and Support Programs:

- Employee Assistance Programs (EAPs) that provide counseling benefits

- Disease management programs

- Wellness programs with significant medical components

- Smoking cessation programs

- Other Health-Related Benefits:

- Medical reimbursement plans

- Severance plans with continued health benefits

- Retiree health benefits

Key Factors That Trigger ERISA Coverage for Health Plans

For a health or welfare benefit arrangement to be subject to ERISA, it generally must meet these criteria:

- Employer Involvement: The plan must be established or maintained by an employer or employee organization

- Ongoing Administration: The plan requires some form of ongoing administrative scheme

- Benefit Purpose: The plan must provide health, medical, or welfare benefits to employees

- Private Sector: The employer must be a private-sector entity, not a governmental or church organization

Understanding these coverage parameters is essential for employers to determine their compliance obligations and for employees to understand their rights under federal health benefit law.

Who Is Exempt from ERISA Health and Welfare Plan Requirements?

While ERISA’s scope for health and welfare plans is extensive, several significant exemptions exist that exclude certain employers and health benefit plans from its requirements. Understanding these exemptions is crucial for organizations to determine their regulatory obligations accurately.

Exempt Employers

Several categories of employers are specifically exempt from ERISA health and welfare plan requirements:

- Government Entities: All levels of government—federal, state, county, and municipal—are exempt from ERISA regulations for their health plans. This includes:

- Federal agencies and departments

- State government offices and agencies

- County and city governments

- Public school systems

- State universities and colleges

- Government hospitals and healthcare facilities

- Religious Organizations: Churches and qualified church-controlled organizations are generally exempt from ERISA health plan requirements. This exemption covers:

- Churches, synagogues, mosques, and other houses of worship

- Church-affiliated schools and universities

- Religious hospitals and healthcare organizations

- Other church-controlled charitable organizations

- However, it’s important to note that church plans can voluntarily elect to be covered by ERISA by filing the appropriate documentation with the Department of Labor.

Non-U.S. Employers: Companies based outside the United States that primarily employ non-resident aliens are typically exempt, even if they have some U.S. operations.

Exempt Health and Welfare Plans

Certain types of health and welfare benefit plans are specifically excluded from ERISA coverage:

- Plans Maintained Solely for Regulatory Compliance: Health plans established solely to comply with workers’ compensation, unemployment, or disability insurance laws are exempt from ERISA.

- Government Health Plans: Health insurance plans established by federal, state, or local governments for their employees, including:

- Federal Employee Health Benefits Program (FEHBP)

- State employee health insurance programs

- Municipal employee health plans

- Military health programs like TRICARE

- Church Health Plans: Health benefit plans established by churches for their employees, unless they elect ERISA coverage.

- Individual Health Insurance Policies: Health insurance policies purchased by individuals directly from insurance companies without employer involvement or contributions.

Voluntary Insurance Programs: When employers have minimal involvement beyond allowing insurance companies to offer voluntary health coverage to employees, these arrangements may be exempt under the “safe harbor” provision.

The "Safe Harbor" Exemption for Certain Group Health Insurance Programs

The Department of Labor has established a regulatory “safe harbor” that exempts certain group health insurance arrangements from ERISA when all of the following conditions are met:

- The employer makes no contributions toward the health program

- Employee participation is completely voluntary

- The employer’s role is limited to collecting premiums and remitting them to insurers

- The employer receives no consideration beyond reasonable compensation for administrative services

Public Health Programs

Government-run public health programs are not considered employer-sponsored welfare benefit plans and are therefore not subject to ERISA:

- Medicare

- Medicaid

- Children’s Health Insurance Program (CHIP)

- State high-risk insurance pools

- Healthcare exchanges established under the Affordable Care Act

Understanding these exemptions helps organizations determine whether they need to comply with ERISA’s extensive requirements for health and welfare plans or if they fall outside its regulatory scope.

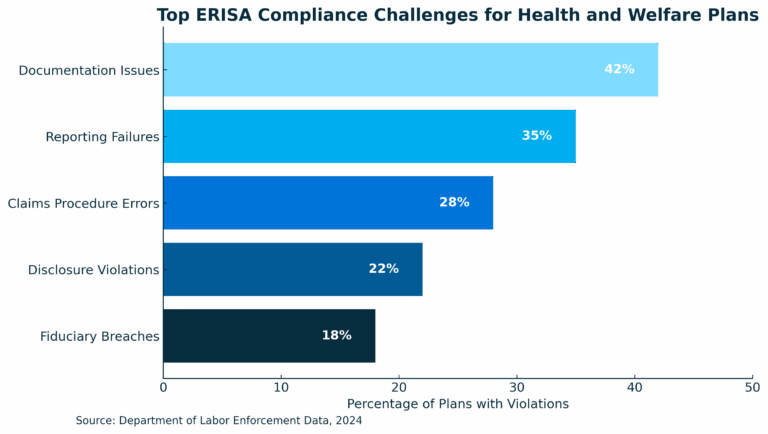

Common ERISA Compliance Challenges for Health and Welfare Plans

Navigating ERISA compliance for health and welfare plans presents numerous challenges for employers of all sizes. Understanding these common pitfalls is the first step toward maintaining compliant benefit programs and avoiding costly penalties.

Documentation and Disclosure Challenges

- Inadequate or Missing Plan Documents: Many employers fail to maintain proper written plan documents for their health and welfare benefits. ERISA requires a formal plan document that outlines:

- Plan benefits and eligibility requirements

- Funding mechanisms

- Claims procedures

- Plan administrator identification

- Amendment and termination provisions

- Outdated or Incomplete Summary Plan Descriptions (SPDs): SPDs must be written in language understandable to the average plan participant and contain specific information about plan benefits and participant rights. Common issues include:

- Failure to update SPDs when plan terms change

- Missing required ERISA language

- Overly technical language that participants cannot reasonably understand

- Failure to distribute SPDs to participants within required timeframes

- Summary of Benefits and Coverage (SBC) Errors: The Affordable Care Act requires group health plans to provide an SBC that accurately summarizes plan benefits in a standardized format. Challenges include:

- Inconsistencies between the SBC and actual plan coverage

- Failure to provide SBCs during enrollment periods

- Not updating SBCs when plan terms change

Reporting and Filing Requirements

- Form 5500 Filing Failures: Many health and welfare plans must file annual Form 5500 reports with the Department of Labor. Common compliance issues include:

- Missing filing deadlines (generally due by the last day of the 7th month after the plan year ends)

- Incomplete or inaccurate information

- Failure to file for all required plans

- Not attaching required schedules or financial information

- COBRA Administration Errors: Continuation coverage under COBRA presents numerous compliance challenges:

- Missed notification deadlines

- Incomplete or inaccurate COBRA notices

- Improper premium calculations

- Failure to offer COBRA to all qualified beneficiaries

Fiduciary Responsibility Issues

- Inadequate Oversight of Service Providers: Plan sponsors often fail to:

- Conduct proper due diligence when selecting third-party administrators

- Monitor service provider performance and fees

- Document the selection and review process

- Understand and evaluate fee arrangements

- Conflicts of Interest: Fiduciaries must act solely in the interest of plan participants, but challenges arise when:

- Decision-makers have financial interests in service providers

- Employers prioritize company interests over participant interests

- Proper procedures aren’t established to manage potential conflicts

- Improper Handling of Plan Assets: Health plan contributions are considered plan assets that must be properly managed:

- Commingling plan assets with company assets

- Delays in transmitting employee contributions to insurance carriers

- Using plan assets for company purposes

Claims Administration Problems

- Non-Compliant Claims Procedures: ERISA establishes specific timeframes and requirements for processing benefit claims:

- Failure to respond to claims within required timeframes

- Inadequate explanation of benefit denials

- Not informing participants of their appeal rights

- Improper handling of appeals

- Inconsistent Claims Decisions: Treating similarly situated participants differently can lead to discrimination claims and fiduciary breaches:

- Inconsistent application of plan terms

- Arbitrary benefit determinations

- Failure to follow plan document provisions

Plan Design and Operation Issues

- ACA Compliance Failures: Health plans must comply with numerous ACA requirements:

- Not offering coverage to all eligible full-time employees

- Plans failing to provide minimum value or affordability

- Not covering preventive services without cost-sharing

- Imposing prohibited annual or lifetime limits

- Mental Health Parity Violations: Ensuring that mental health and substance use disorder benefits are at parity with medical/surgical benefits is complex:

- Disparate financial requirements (deductibles, copays)

- More restrictive treatment limitations

- Unequal application of medical necessity criteria

- Non-compliant network design

Understanding these common compliance challenges helps employers identify potential issues in their health and welfare benefit programs before they result in DOL investigations, participant lawsuits, or significant financial penalties.

How to Stay Compliant If You're Subject to ERISA

Maintaining compliance with ERISA requirements for health and welfare plans requires diligence, attention to detail, and a systematic approach. Here’s a comprehensive guide to help employers navigate these complex requirements and avoid costly penalties.

📄 Establish Proper Plan Documentation

Create and Maintain Written Plan Documents: Every ERISA-covered health and welfare plan must have a formal written plan document that includes:

- Plan name and identification number

- Plan sponsor and administrator information

- Eligibility requirements

- Description of benefits

- Funding mechanism

- Claims procedures

- Amendment and termination provisions

- ERISA-required provisions

Develop Compliant Summary Plan Descriptions (SPDs): Create SPDs that explain plan benefits in language understandable to the average participant:

- Use clear, non-technical language

- Include all ERISA-required content

- Distribute to participants within 90 days of enrollment

- Update and redistribute when material changes occur

- Provide electronic distribution only when DOL requirements are met

Prepare and Distribute Required Notices: Ensure timely distribution of all required disclosures:

- Summary of Benefits and Coverage (SBC)

- COBRA notices

- HIPAA privacy notices

- Women’s Health and Cancer Rights Act notices

- Medicare Part D creditable coverage notices

- Summary of Material Modifications (SMM) when plan changes occur

⚙️ Implement Proper Administrative Procedures

Establish a Compliance Calendar: Create a schedule of important deadlines:

- Form 5500 filing dates

- Required participant disclosures

- Plan document updates

- Annual compliance reviews

Document Fiduciary Processes: Maintain records of decision-making processes:

- Committee meeting minutes

- Service provider selection criteria

- Fee benchmarking analyses

- Plan investment reviews (for funded welfare plans)

Develop Compliant Claims Procedures: Ensure your claims process meets ERISA requirements:

- Establish reasonable timeframes for claims decisions

- Provide adequate explanations for claim denials

- Implement a thorough appeals process

- Train staff on proper claims handling

📡 Monitor Service Providers

Conduct Due Diligence: Thoroughly evaluate third-party administrators, insurers, and consultants:

- Review qualifications and experience

- Check references and performance history

- Evaluate fee structures for reasonableness

- Assess quality of services provided

Document Service Provider Arrangements: Maintain written agreements that clearly outline:

- Services to be provided

- Fee arrangements and compensation

- Performance standards

- Fiduciary status and responsibilities

- Termination provisions

Regularly Review Performance: Conduct periodic assessments of service providers:

- Monitor performance against established standards

- Review fees for reasonableness

- Address service issues promptly

- Document review process and outcomes

📰 Stay Current with Regulatory Changes

Conduct Due Diligence: Thoroughly evaluate third-party administrators, insurers, and consultants:

- Review qualifications and experience

- Check references and performance history

- Evaluate fee structures for reasonableness

- Assess quality of services provided

Document Service Provider Arrangements: Maintain written agreements that clearly outline:

- Services to be provided

- Fee arrangements and compensation

- Performance standards

- Fiduciary status and responsibilities

- Termination provisions

Regularly Review Performance: Conduct periodic assessments of service providers:

- Monitor performance against established standards

- Review fees for reasonableness

- Address service issues promptly

- Document review process and outcomes

🔍 Conduct Regular Compliance Audits

Perform Self-Audits: Regularly review your health and welfare plans for compliance:

- Verify all required documents exist and are up-to-date

- Ensure timely distribution of required notices

- Confirm proper filing of Form 5500s

- Test claims processing for compliance with ERISA timeframes

Address Compliance Gaps: When issues are identified:

- Document the compliance gap

- Develop a corrective action plan

- Implement necessary changes

- Consider voluntary correction programs when available

Consider External Compliance Reviews: Periodically engage outside experts:

- ERISA attorneys

- Compliance consultants

- Employee benefits specialists

By following these comprehensive compliance strategies, employers can significantly reduce their risk of ERISA violations, DOL investigations, and participant lawsuits related to their health and welfare benefit plans.

ERISA Coverage for Health and Welfare Plans

Employer-Sponsored Group Health Insurance

- Subject to ERISA? Yes

- Key Requirements: Plan document, SPD, claims procedures, fiduciary standards, Form 5500 filing

- Notable Exemptions: Government plans, church plans, plans for only business owners

Self-Funded Health Plans

- Subject to ERISA? Yes

- Key Requirements: Plan document, SPD, claims procedures, fiduciary standards, Form 5500 filing

- Notable Exemptions: Government plans, church plans

Dental Insurance

- Subject to ERISA? Yes

- Key Requirements: Plan document, SPD, claims procedures

- Notable Exemptions: Voluntary plans meeting safe harbor criteria

Vision Insurance

- Subject to ERISA? Yes

- Key Requirements: Plan document, SPD, claims procedures

- Notable Exemptions: Voluntary plans meeting safe harbor criteria

Prescription Drug Coverage

- Subject to ERISA? Yes

- Key Requirements: Plan document, SPD, claims procedures

- Notable Exemptions: When part of exempt plan

Health FSAs

- Subject to ERISA? Yes

- Key Requirements: Plan document, SPD, claims procedures

- Notable Exemptions: Government and church employers

HRAs

- Subject to ERISA? Yes

- Key Requirements: Plan document, SPD, claims procedures

- Notable Exemptions: Certain limited HRAs

HSAs

- Subject to ERISA? Generally No*

- Key Requirements: N/A

- Notable Exemptions: *Unless significant employer involvement beyond contributions

Group Life Insurance

- Subject to ERISA? Yes

- Key Requirements: Plan document, SPD, claims procedures

- Notable Exemptions: Voluntary plans meeting safe harbor criteria

Disability Insurance

- Subject to ERISA? Yes

- Key Requirements: Plan document, SPD, claims procedures

- Notable Exemptions: Voluntary plans meeting safe harbor criteria

Employee Assistance Programs (EAPs)

- Subject to ERISA? Usually Yes

- Key Requirements: Plan document, SPD, claims procedures

- Notable Exemptions: EAPs offering only referral services with minimal employer involvement

Wellness Programs

- Subject to ERISA? Usually Yes

- Key Requirements: Plan document, SPD, claims procedures

- Notable Exemptions: Programs with no medical benefits or minimal employer involvement

Voluntary Insurance Plans

- Subject to ERISA? Generally No

- Key Requirements: N/A

- Notable Exemptions: Employer involvement must be minimal to remain exempt

Frequently Asked Questions (FAQs)

Are Church or Government Plans Covered Under ERISA?

No, church and government plans are specifically exempt from ERISA coverage. The law explicitly excludes benefit plans established or maintained by churches, conventions of churches, or church-affiliated organizations primarily for the benefit of their employees. Similarly, health and welfare plans established by federal, state, or local governments for their employees are exempt from ERISA requirements.

However, it’s important to note that church plans can voluntarily elect to be covered by ERISA by filing the appropriate documentation with the Department of Labor. Once a church plan makes this election, it becomes subject to the same ERISA requirements as other private-sector health plans.

While these plans are exempt from ERISA, they are still subject to other federal and state laws governing health benefits. Government plans must comply with applicable public sector regulations, and church plans remain subject to certain federal requirements, such as HIPAA’s privacy provisions in many cases.

Does ERISA Apply to Public Employees?

No, ERISA does not apply to public employees. Health and welfare benefit plans established by federal, state, county, or municipal governments for their employees are specifically exempt from ERISA coverage. This exemption includes:

- Federal employee health benefit programs

- State employee health insurance plans

- Public school district employee benefits

- City and county government employee health plans

- Public university employee benefit programs

- Government agency health insurance offerings

Public employees’ health benefits are instead governed by specific government regulations at the federal, state, or local level. These regulations often provide similar protections to ERISA but may vary significantly in their specific requirements and enforcement mechanisms.

Public employees should consult their specific plan documents and relevant government regulations to understand their rights and the rules governing their health benefits, rather than looking to ERISA for guidance.

Does ERISA Apply to Independent Contractors or Only Full-Time Employees?

ERISA applies to employee benefit plans, and by definition, independent contractors are not employees. Therefore, health and welfare benefits provided to genuine independent contractors are not subject to ERISA requirements. However, several important considerations apply:

- Worker Classification Matters: The determination of whether someone is an employee or independent contractor is based on the actual working relationship, not just how they’re classified on paper. Misclassifying employees as independent contractors doesn’t exempt an employer from ERISA compliance.

- Part-Time Employee Coverage: ERISA can apply to health plans covering part-time employees. The law doesn’t distinguish between full-time and part-time status—if someone is legally an employee and covered by an employer-sponsored health plan, ERISA typically applies.

- Eligibility Requirements: While ERISA governs the plan itself, employers can establish eligibility requirements that limit participation to certain categories of employees, such as those working a minimum number of hours.

- Self-Employed Individuals: Health insurance purchased by self-employed individuals without employees is generally not subject to ERISA, as there’s no employer-employee relationship.

If you’re uncertain about your status and ERISA’s applicability to your health benefits, consulting with an employee benefits attorney can provide clarity based on your specific situation.

How Do I Know If My Benefit Plan Is Subject to ERISA?

Determining whether your health or welfare benefit plan is subject to ERISA involves examining several key factors:

- Employer Type: If your employer is a private-sector company (not a government entity or church), your health plan is likely subject to ERISA.

- Employer Involvement: Look for employer actions such as:

- Making contributions toward premiums

- Selecting the insurance carrier or plan options

- Negotiating plan terms

- Handling claims or appeals

- Promoting the plan to employees

- Plan Documentation: Check your benefit materials for references to ERISA, a Summary Plan Description (SPD), or Form 5500 filings, which indicate ERISA coverage.

- Voluntary Plan Safe Harbor: If all of these conditions are met, the plan may be exempt:

- No employer contributions

- Completely voluntary employee participation

- Minimal employer involvement (only collecting premiums)

- No employer profit from the plan

- Plan Type: Certain plans are typically subject to ERISA:

- Employer-sponsored group health insurance

- Self-funded health plans

- Health FSAs and many HRAs

- Group dental, vision, and prescription drug plans

- Employer-provided disability and life insurance

If you’re still uncertain, you can:

- Ask your HR department or benefits administrator directly

- Request a copy of the Summary Plan Description

- Consult with an employee benefits attorney

- Contact the Department of Labor’s Employee Benefits Security Administration (EBSA) for guidance

Conclusion

Understanding ERISA’s application to health and welfare benefit plans is essential for both employers offering these benefits and employees relying on them. As we’ve explored throughout this article, ERISA establishes critical protections for participants in employer-sponsored health plans while imposing significant compliance obligations on plan sponsors and administrators.

The scope of ERISA is broad, covering most private-sector employers who offer health and welfare benefits, yet important exemptions exist for government employers, church plans, and certain voluntary arrangements. Knowing where your organization or benefit plan falls within this regulatory framework is the first step toward ensuring compliance or understanding your rights as a participant.

For employers subject to ERISA, compliance requires attention to detail across multiple areas: maintaining proper plan documentation, fulfilling disclosure obligations, establishing compliant claims procedures, meeting reporting requirements, and upholding fiduciary responsibilities. The challenges are significant, but with proper systems and professional guidance, they can be effectively managed.

For employees, ERISA provides important protections—ensuring access to plan information, establishing standards for claims processing, creating appeal rights, and imposing fiduciary duties on those who manage health plan assets. Understanding these protections helps employees advocate for their rights when issues arise.

As healthcare continues to evolve and regulatory requirements change, staying informed about ERISA’s application to health and welfare plans becomes increasingly important. By maintaining compliance with these federal standards, employers not only avoid potential penalties but also fulfill their commitment to providing reliable health benefits to their workforce—a critical component of employee well-being and organizational success.

Whether you’re an HR professional navigating compliance requirements, a business owner evaluating benefit options, or an employee seeking to understand your rights, we hope this guide has provided valuable insights into who is subject to ERISA and what that means for health and welfare benefit plans.

References

- U.S. Department of Labor. (2024). “ERISA.” Employee Benefits Security Administration. https://www.dol.gov/general/topic/health-plans/erisa

- DeBofsky, M. (2023, May 11 ). “How Can I Tell If My Benefit Plan Is Governed by ERISA?” DeBofsky Law. https://www.debofsky.com/articles/benefit-plan-is-governed-by-erisa/

- Donohue, A. (2024, April 12 ). “What Benefit Plans Are Subject To ERISA?” PrimePay. https://primepay.com/learn/compliance/what-benefit-plans-are-subject-to-erisa/

- Peace Law Firm. (2022, May 5 ). “Who Is Subject to ERISA?” https://www.peacelawfirm.com/who-is-subject-to-erisa/

- Employee Benefits Security Administration. (2023 ). “Health Plans & Benefits: ERISA Compliance.” U.S. Department of Labor. https://www.dol.gov/agencies/ebsa/employers-and-advisers/plan-administration-and-compliance/health-plans

- U.S. Department of Labor. (2022 ). “Reporting and Disclosure Guide for Employee Benefit Plans.” Employee Benefits Security Administration. https://www.dol.gov/sites/dolgov/files/EBSA/about-ebsa/our-activities/resource-center/publications/reporting-and-disclosure-guide-for-employee-benefit-plans.pdf

- Internal Revenue Service. (2024 ). “Retirement Plan Reporting and Disclosure Requirements.” https://www.irs.gov/retirement-plans/retirement-plan-reporting-and-disclosure-requirements

- Society for Human Resource Management. (2023 ). “ERISA Compliance FAQs.” https://www.shrm.org/resourcesandtools/tools-and-samples/hr-qa/pages/cms_020618.aspx

- Employee Benefits Security Administration. (2024 ). “Understanding Your Fiduciary Responsibilities Under a Group Health Plan.” U.S. Department of Labor. https://www.dol.gov/sites/dolgov/files/EBSA/about-ebsa/our-activities/resource-center/publications/understanding-your-fiduciary-responsibilities-under-a-group-health-plan.pdf

- American Bar Association. (2023 ). “Employee Benefits Law.” Section of Labor and Employment Law. https://www.americanbar.org/groups/labor_law/resources/employee_benefits_law/