Self-insured medical plans offer significant advantages for employers, including potential cost savings through eliminated premium taxes and carrier profit margins, enhanced cash flow from pay-as-you-go claim funding, complete plan design flexibility, valuable claims data access, and exemption from state insurance mandates. While these plans carry increased financial risk and administrative responsibilities, implementing strategies like stop-loss insurance and third-party administration can effectively mitigate these challenges. Self-funding works best for organizations with stable employee populations, predictable claims history, and sufficient financial reserves, though innovative solutions now make these plans accessible to smaller businesses as well. Maximizing benefits requires strategic planning, proactive risk management, and ongoing plan optimization based on detailed claims analysis.

What is a Self-Insured Medical Plan?

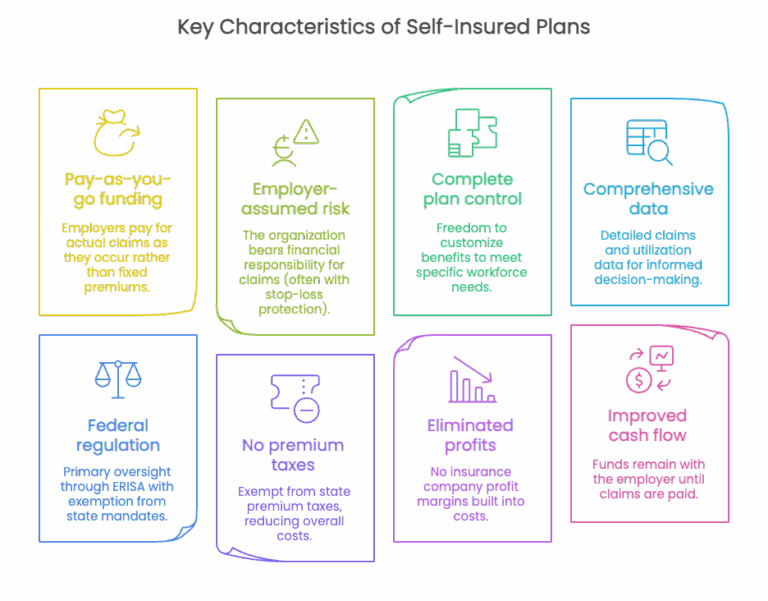

A self-insured medical plan (also known as a self-funded health plan) is a healthcare financing arrangement in which an employer assumes direct financial responsibility for covering their employees’ medical claims. Rather than purchasing traditional health insurance from a carrier and paying fixed monthly premiums, the organization sets aside funds to pay employee healthcare expenses as they occur.

In this model, the employer creates a dedicated fund or trust from which employee healthcare claims are paid. The company essentially becomes its own insurer, taking on the financial risk that would otherwise be transferred to an insurance company in a fully-insured arrangement.

While the employer bears the ultimate financial responsibility, most self-insured plans are administered by third-party administrators (TPAs) or insurance companies operating in an administrative services only (ASO) capacity. These entities handle the day-to-day operations of the plan, including:

- Processing and paying claims

- Providing access to provider networks

- Managing pharmacy benefits

- Offering customer service support

- Ensuring regulatory compliance

- Generating reports and analytics

Self-insured plans are regulated primarily at the federal level under the Employee Retirement Income Security Act (ERISA), which exempts them from many state insurance regulations and mandates. This federal oversight creates a more uniform regulatory environment for multi-state employers while allowing greater flexibility in plan design.

According to industry data, self-insurance has become increasingly prevalent across organizations of all sizes. While traditionally associated with large corporations having 1,000+ employees, innovative funding arrangements and risk management strategies have made self-funding viable for mid-sized and even smaller companies in recent years.

Self Insured vs. Fully Insured Models for Health Insurance

Understanding the fundamental differences between self-insured and fully-insured health plans is essential for making informed decisions about your organization’s healthcare strategy. These two models represent distinctly different approaches to financing and managing employee health benefits.

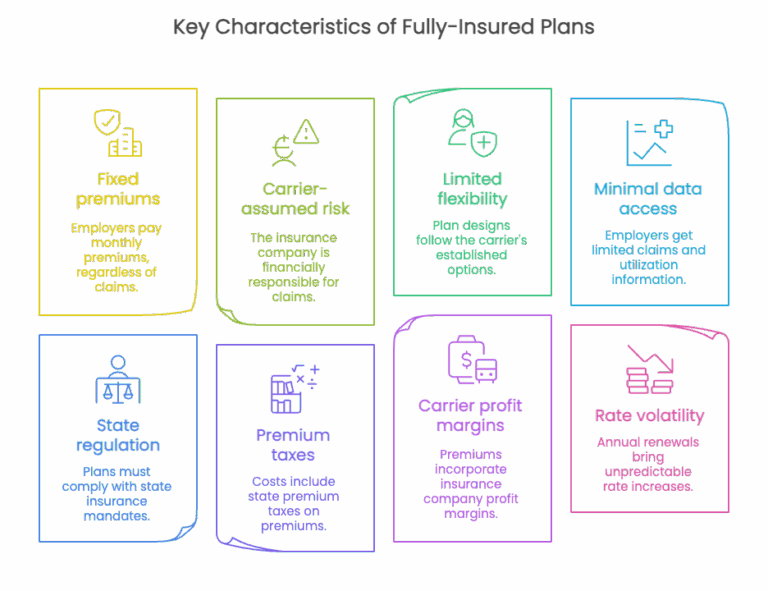

Fully-Insured Health Plans

In a fully-insured arrangement, an employer purchases health coverage from an insurance carrier by paying fixed monthly premiums. The insurance company assumes all financial risk for covering employees’ medical expenses and handles all aspects of plan administration. This traditional approach offers predictability but often comes with significant limitations.

Self-Insured Health Plans

In a fully-insured arrangement, an employer purchases health coverage from an insurance carrier by paying fixed monthly premiums. The insurance company assumes all financial risk for covering employees’ medical expenses and handles all aspects of plan administration. This traditional approach offers predictability but often comes with significant limitations.

Comparative Analysis

The following table provides a side-by-side comparison of these two models across key dimensions:

| Feature | Fully-Insured Plans | Self-Insured Plans |

|---|---|---|

| Financial Risk | Assumed by insurance carrier | Assumed by employer (with stop-loss protection) |

| Cost Structure | Fixed monthly premiums | Administrative fees plus actual claims costs |

| Plan Design Flexibility | Limited to carrier options | Complete customization possible |

| Regulatory Framework | State insurance laws and mandates | Federal ERISA regulations |

| Data Transparency | Limited claims reporting | Comprehensive claims data access |

| Cash Flow Impact | Prepaid premiums | Pay-as-you-go claims funding |

| Administrative Burden | Minimal employer involvement | Increased employer responsibility |

| Cost Savings Potential | Limited | Significant through eliminated taxes and margins |

| Rate Stability | Subject to annual carrier increases | Based on organization’s actual experience |

| Ideal Organization Size | Small to mid-sized employers | Traditionally larger employers, now accessible to smaller groups |

The choice between these models depends on numerous factors including organization size, risk tolerance, financial resources, and strategic objectives. While fully-insured plans offer simplicity and predictability, self-insured arrangements provide greater control and potential cost advantages for organizations willing to assume additional responsibility and managed risk.

Benefits From Self-Insured Medical Plans

Self-insured medical plans offer numerous strategic advantages for organizations seeking greater control over their healthcare costs and benefits design. These advantages extend beyond simple cost savings to include enhanced flexibility, improved data access, and better alignment with organizational objectives.

1. Potential Cost Savings

One of the most compelling benefits of self-insurance is the potential for significant cost savings through multiple avenues:

- Elimination of premium taxes: Self-insured plans are exempt from state premium taxes, which typically range from 2-3% of premium costs in fully-insured arrangements.

- Removal of carrier profit margins: By eliminating the insurance company middleman, employers avoid paying the profit margins built into traditional premiums.

- Reduced administrative costs: While administrative expenses still exist, they’re often lower than the administrative component of fully-insured premiums.

- Payment for actual claims only: Organizations pay for actual healthcare utilization rather than inflated premiums based on projected costs and risk factors.

Improved cash flow: Funds remain with the employer until claims are paid, allowing for investment opportunities and improved cash management.

2. Complete Plan Design Flexibility

Self-funding provides unparalleled freedom to design health benefits that precisely match your organization’s unique needs:

- Customized benefits package: Create a plan that reflects your workforce demographics, health priorities, and organizational values.

- Targeted wellness initiatives: Implement specific programs addressing your employee population’s actual health challenges.

- Flexible provider networks: Select or customize provider networks based on geographic distribution and quality metrics.

- Innovative benefit structures: Incorporate cutting-edge approaches like value-based benefits, centers of excellence, and reference-based pricing.

Rapid adaptation: Modify plan designs quickly in response to emerging needs without waiting for carrier approval.

3. Valuable Claims Data Access

Self-insured plans provide employers with comprehensive data that can drive strategic decision-making:

- Detailed utilization patterns: Understand exactly how employees are using healthcare services.

- Cost driver identification: Pinpoint specific conditions, treatments, or providers driving healthcare expenses.

- ROI measurement: Evaluate the effectiveness of wellness programs and benefit design changes.

- Predictive analytics: Leverage data to forecast future healthcare needs and costs.

Targeted interventions: Develop precisely focused programs addressing actual employee health challenges.

4. Regulatory Advantages

Self-insured plans operate under federal ERISA regulations rather than state insurance laws, creating several advantages:

- Exemption from state mandates: Avoid costly state-mandated benefits that may not align with your population’s needs.

- Uniform multi-state administration: Maintain consistent benefits across state lines without navigating different regulatory requirements.

- Reduced reporting requirements: Face fewer administrative burdens than fully-insured plans in many cases.

Greater legal protections: Benefit from ERISA’s preemption of state laws that might otherwise restrict plan design options.

5. Enhanced Control Over Healthcare Quality

Self-funding enables organizations to take a more active role in ensuring healthcare quality:

- Direct provider contracting: Establish direct relationships with high-quality providers for better rates and care coordination.

- Performance-based provider arrangements: Implement value-based reimbursement models rewarding quality outcomes.

- Specialized care management: Develop custom care management programs for prevalent conditions in your population.

- Quality metric tracking: Monitor and incentivize improvements in care quality and outcomes.

6. Improved Financial Predictability

While self-insurance involves assuming risk, it can actually improve financial predictability through:

- Detailed claims forecasting: Use historical data to develop accurate projections of future costs.

- Smoothed cash flow: Avoid the large annual premium increases common with fully-insured plans.

- Stop-loss protection: Limit catastrophic claim exposure through appropriate reinsurance.

Reserve development: Build financial reserves based on actual experience rather than carrier projections.

Value Assessment Matrix

The following matrix illustrates the relative value of self-insured benefits across different organizational characteristics:

| Benefit Category | Small Organizations (50-100 employees) | Mid-Size Organizations (100-500 employees) | Large Organizations (500+ employees) |

|---|---|---|---|

| Cost Savings | 🔵🔵⚪⚪ | 🔵🔵🔵⚪ | 🔵🔵🔵🔵 |

| Plan Flexibility | 🔵🔵🔵⚪ | 🔵🔵🔵🔵 | 🔵🔵🔵🔵 |

| Data Access | 🔵🔵⚪⚪ | 🔵🔵🔵⚪ | 🔵🔵🔵🔵 |

| Regulatory Advantages | 🔵🔵🔵⚪ | 🔵🔵🔵⚪ | 🔵🔵🔵🔵 |

| Healthcare Quality Control | 🔵⚪⚪⚪ | 🔵🔵🔵⚪ | 🔵🔵🔵🔵 |

| Financial Predictability | 🔵⚪⚪⚪ | 🔵🔵⚪⚪ | 🔵🔵🔵⚪ |

Rating scale: 🔵⚪⚪⚪ = Minimal value, 🔵🔵⚪⚪ = Moderate value, 🔵🔵🔵⚪ = Significant value, 🔵🔵🔵🔵 = Maximum value

The benefits of self-insurance increase substantially with organizational size due to greater risk pooling, enhanced negotiating leverage, and economies of scale in administration. However, innovative funding approaches are increasingly making these advantages accessible to smaller organizations as well.

Common Problems With Self Funded Insurance and How to Solve Them

While self-insured medical plans offer numerous advantages, they also present distinct challenges that organizations must address to maximize benefits and minimize risks. Understanding these common problems and implementing effective solutions is essential for successful self-funding.

1. Financial Risk Exposure

Problem: The most significant concern with self-insurance is the potential for catastrophic claims or unexpectedly high utilization that could strain an organization’s finances.

Solutions:

- Implement comprehensive stop-loss coverage: Purchase appropriate specific and aggregate stop-loss insurance to cap liability for both individual high-cost claims and overall plan expenses.

- Establish adequate reserves: Maintain sufficient financial reserves to handle claim fluctuations without disrupting operations.

- Consider level-funding arrangements: For smaller organizations, level-funded plans offer the benefits of self-insurance with more predictable monthly payments.

Develop contingency planning: Create detailed financial contingency plans for worst-case scenarios.

2. Administrative Complexity

Problem: Self-insured plans require significantly more administrative oversight and expertise than fully-insured arrangements.

Solutions:

- Partner with experienced TPAs: Select third-party administrators with proven track records in managing self-funded plans.

- Implement robust benefits administration systems: Utilize specialized software platforms designed for self-funded plan management.

- Establish clear governance structures: Develop formal committees and decision-making processes for plan oversight.

Consider partial outsourcing: Maintain strategic control while outsourcing technical administrative functions.

3. Compliance Challenges

Problem: Self-insured plans must navigate complex federal regulations including ERISA, ACA, HIPAA, and other requirements.

Solutions:

- Engage specialized legal counsel: Work with attorneys experienced in self-funded plan compliance.

- Conduct regular compliance audits: Implement systematic reviews of plan documents and operations.

- Maintain comprehensive documentation: Keep detailed records of plan decisions, changes, and communications.

Stay current with regulatory changes: Establish processes to monitor and respond to evolving regulations.

4. Cash Flow Management

Problem: Unlike predictable premium payments, self-funded claims can fluctuate significantly month-to-month, creating cash flow challenges.

Solutions:

- Implement claims forecasting models: Use historical data and actuarial projections to anticipate future expenses.

- Establish dedicated funding accounts: Create separate accounts specifically for healthcare claim payments.

- Consider claim stabilization approaches: Explore options like minimum premium arrangements or banking arrangements with TPAs.

Develop systematic funding schedules: Create structured processes for regular fund transfers to claims accounts.

5. Provider Network Limitations

Problem: Smaller self-insured plans may struggle to access competitive provider networks and negotiated rates.

Solutions:

- Join self-funded coalitions: Participate in employer coalitions that aggregate purchasing power.

- Explore reference-based pricing models: Consider alternatives to traditional network arrangements.

- Implement direct provider contracting: Establish direct relationships with key providers for your population.

Utilize network rental arrangements: Access established networks through TPAs or specialized vendors.

Risk Management Framework

| Risk Category | Prevention Strategies | Mitigation Strategies | Contingency Planning |

|---|---|---|---|

| Financial Risk | • Actuarial analysis • Conservative budgeting • Predictive modeling |

• Comprehensive stop-loss • Adequate reserves • Level-funding options |

• Emergency funding sources • Plan modification triggers • Reinsurance arrangements |

| Administrative Risk | • Experienced partners • Clear procedures • Staff training |

• Technology solutions • Outsourced expertise • Regular audits |

• Backup administrators • Documented processes • Cross-training |

| Compliance Risk | • Legal review • Regulatory monitoring • Documentation systems |

• Compliance calendars • Expert consultants • Regular self-audits |

• Remediation protocols • Disclosure procedures • Legal defense preparation |

| Cash Flow Risk | • Claims forecasting • Reserve development • Funding discipline |

• Banking arrangements • Staggered payments • Claim timing management |

• Credit facilities • Emergency reserves • Payment prioritization |

| Network Risk | • Coalition membership • Multi-year contracts • Provider partnerships |

• Alternative networks • Centers of excellence • Telehealth options |

• Out-of-network protocols • Patient advocacy services • Travel benefits |

Problem-Solution Decision Matrix

When evaluating whether self-funding is appropriate for your organization, consider this decision framework:

| Organization Characteristic | Low Risk for Self-Funding | Medium Risk for Self-Funding | High Risk for Self-Funding |

|---|---|---|---|

| Financial Stability | Strong reserves and consistent cash flow | Adequate reserves with some fluctuation | Limited reserves or unstable cash flow |

| Employee Population Size | 200+ employees | 100-200 employees | Fewer than 100 employees |

| Claims History | Stable, predictable claims experience | Moderately variable claims history | Highly volatile or unknown claims history |

| Risk Tolerance | Comfortable with managed financial risk | Moderate risk tolerance | Strong preference for predictability |

| Administrative Capacity | Robust benefits team with self-funding experience | Adequate staffing with some expertise | Limited benefits resources or expertise |

By systematically addressing these common challenges through thoughtful planning and strategic partnerships, organizations can overcome the potential drawbacks of self-insurance and fully realize its benefits.

How to Maximize Benefits From Self-Insured Medical Plans

Implementing a self-insured medical plan is just the beginning. To truly optimize the advantages of self-funding, organizations must adopt strategic approaches that enhance cost control, improve healthcare quality, and maximize the value of their health benefits investment. Here are key strategies for getting the most from your self-insured plan.

Strategic Plan Design

Thoughtful plan design is the foundation of an effective self-insured program:

- Value-based benefit structures: Implement tiered benefits that encourage high-value care while discouraging low-value services.

- Targeted incentives: Create financial incentives for preventive care, chronic condition management, and healthy behaviors.

- Alternative care delivery models: Incorporate telehealth, on-site clinics, and direct primary care arrangements.

- Specialized carve-out programs: Develop focused programs for high-cost conditions like diabetes, musculoskeletal disorders, and cancer.

- Pharmacy benefit optimization: Implement formulary management, specialty drug protocols, and pharmacy network strategies.

Data-Driven Decision Making

One of self-funding’s greatest advantages is access to comprehensive claims data. Leverage this information to:

- Conduct regular plan performance analysis: Review detailed utilization patterns, cost trends, and clinical outcomes.

- Identify specific cost drivers: Pinpoint particular conditions, treatments, providers, or member segments driving expenses.

- Measure intervention effectiveness: Evaluate the ROI of wellness programs, disease management, and benefit design changes.

- Develop predictive models: Use historical data to forecast future trends and anticipate emerging issues.

Create targeted communication strategies: Design communications addressing actual health challenges in your population.

Provider Partnership Development

Actively manage provider relationships to improve both quality and cost-effectiveness:

- Direct contracting arrangements: Establish direct relationships with high-performing providers.

- Centers of excellence programs: Identify and steer members to providers demonstrating superior outcomes for specific procedures.

- Value-based payment models: Implement reimbursement approaches that reward quality and efficiency.

- Bundled payment arrangements: Contract for episodes of care rather than individual services.

- Quality metric tracking: Monitor provider performance on key quality indicators.

Risk Management Optimization

Sophisticated risk management strategies can significantly enhance financial performance:

- Customized stop-loss coverage: Design specific and aggregate protection aligned with your risk profile.

- Alternative funding approaches: Consider captive arrangements, consortium models, or level-funding for enhanced stability.

- Reserve development strategies: Establish appropriate reserves based on actuarial analysis.

- Reinsurance market leverage: Regularly market stop-loss coverage to ensure competitive terms.

- Risk corridor arrangements: Implement risk-sharing approaches with TPAs or provider partners.

Member Engagement Enhancement

Actively engaged plan members make better healthcare decisions:

- Personalized decision support: Provide tools helping members navigate the healthcare system effectively.

- Transparency resources: Offer cost and quality comparison tools for informed provider selection.

- Health literacy initiatives: Educate members about healthcare concepts and effective system utilization.

- Digital engagement platforms: Implement mobile apps and online portals for convenient access to benefits information.

- Incentive program design: Create meaningful rewards for positive health behaviors and smart healthcare choices.

Vendor Management Excellence

Strategic vendor partnerships are critical to self-funding success:

- Performance-based contracts: Structure agreements with TPAs and other vendors around measurable outcomes.

- Regular vendor evaluations: Conduct systematic assessments of vendor performance against established metrics.

- Integration requirements: Ensure seamless coordination between multiple vendors and programs.

- Innovation partnerships: Collaborate with vendors on developing customized solutions for your population.

- Competitive bidding processes: Regularly market services to ensure optimal pricing and performance.

Optimization Roadmap

| Phase | Focus Areas | Key Activities | Expected Outcomes |

|---|---|---|---|

| Foundation (Year 1) |

• Basic plan design • Core vendor selection • Initial data collection |

• Implement fundamental plan structure • Establish administrative processes • Begin data gathering |

• Operational stability • Administrative efficiency • Baseline metrics |

| Optimization (Years 2-3) |

• Data analysis • Targeted interventions • Network refinement |

• Analyze utilization patterns • Implement focused programs • Enhance provider arrangements |

• Cost trend moderation • Improved clinical outcomes • Enhanced member experience |

| Innovation (Years 4+) |

• Advanced payment models • Predictive analytics • Ecosystem development |

• Implement value-based arrangements • Deploy predictive modeling • Create integrated care systems |

• Sustainable cost control • Superior health outcomes • Competitive advantage |

Self-Funding Maturity Model

Organizations typically progress through several stages of self-funding sophistication:

| Maturity Level | Characteristics | Focus Areas | Value Realization |

|---|---|---|---|

| Level 1: Basic Implementation | • Standard TPA arrangement • Generic plan design • Minimal data utilization | • Administrative stability • Regulatory compliance • Basic financial management | Low to Moderate |

| Level 2: Active Management | • Enhanced data analysis • Targeted interventions • Strategic vendor selection | • Cost containment • Quality improvement • Member engagement | Moderate to High |

| Level 3: Strategic Integration | • Comprehensive data strategy • Value-based arrangements • Ecosystem development | • Healthcare transformation • Population health management • Innovative delivery models | High to Very High |

By systematically progressing through these maturity levels and implementing the strategies outlined above, organizations can transform their self-insured plans from simple financing mechanisms into powerful tools for controlling healthcare costs, improving employee health, and creating competitive advantage.

Frequently Asked Questions (FAQs)

What Tax Benefits are Associated With Self-Insured Medical Plans?

Self-insured medical plans offer several significant tax advantages that can substantially reduce healthcare costs:

- Premium tax exemption: Self-insured plans are exempt from state premium taxes, which typically range from 2-3% of premium costs in fully-insured arrangements.

- ERISA pre-emption benefits: Operating under federal ERISA regulations rather than state insurance laws often results in reduced compliance costs and administrative burdens.

- Pre-tax contributions: Employee contributions to self-insured plans can be made on a pre-tax basis through Section 125 cafeteria plans, reducing both employer and employee tax liabilities.

- Reserve fund flexibility: Unlike insurance premiums, funds set aside for future claims remain with the employer until needed, allowing for potential investment income.

- HSA compatibility: Self-insured plans can be designed to be HSA-compatible, enabling additional tax advantages through employee health savings accounts.

It’s important to note that while self-insured plans offer tax advantages, they must still comply with applicable federal regulations including ACA requirements, HIPAA privacy rules, and ERISA fiduciary responsibilities.

Who Should Not Opt for a Self-Funded Insurance Plan?

While self-funding offers numerous benefits, it isn’t appropriate for every organization. The following factors may indicate that self-insurance is not the right choice:

- Small, unstable employee populations: Organizations with fewer than 50-100 employees generally lack sufficient risk pooling for predictable claims experience.

- Limited financial reserves: Companies without adequate cash reserves or access to capital may struggle to handle claim fluctuations.

- Highly risk-averse culture: Organizations with low risk tolerance or requiring absolute budget certainty may find self-funding too stressful.

- Minimal benefits expertise: Employers lacking internal benefits knowledge or unwilling to engage expert partners may struggle with self-funding complexity.

- Short-term focus: Organizations seeking immediate cost savings without commitment to long-term strategy may be disappointed with self-funding results.

- Unstable business conditions: Companies experiencing significant financial instability, rapid workforce changes, or potential merger/acquisition activity may want to delay self-funding.

Alternative approaches for these organizations might include level-funded plans (which combine self-funding elements with premium-like payments), participation in professional employer organizations (PEOs), or traditional fully-insured arrangements with carefully negotiated terms.

How Do Self-Insured Health Plans Save Money?

Self-insured health plans generate cost savings through multiple mechanisms:

- Elimination of risk charges: Traditional insurance premiums include risk charges (typically 2-5% of premiums) that self-insured plans avoid.

- Reduced administrative costs: While administrative expenses still exist, they’re often lower than the administrative component of fully-insured premiums (which can be 10-15% of premiums).

- Exemption from state premium taxes: Self-insured plans avoid state premium taxes, typically saving 2-3% of equivalent premium costs.

- Improved cash flow: Claims are paid as incurred rather than through advance premiums, allowing organizations to retain and potentially invest funds until needed.

- Plan design optimization: Customized benefits can be precisely tailored to workforce needs, eliminating unnecessary coverage while enhancing high-value benefits.

- Data-driven interventions: Access to comprehensive claims data enables targeted cost-containment strategies addressing specific utilization patterns.

- Direct provider contracting: Self-insured plans can establish direct relationships with providers, potentially securing more favorable reimbursement terms.

- Avoidance of ACA market share fees: Self-insured plans are exempt from certain ACA fees that apply to fully-insured arrangements.

According to industry studies, mature self-insured plans typically demonstrate 5-15% lower costs than comparable fully-insured arrangements over time, though results vary based on implementation quality and organizational commitment to active management.

Conclusion

Self-insured medical plans represent a powerful strategic approach for organizations seeking greater control over healthcare costs, enhanced benefit flexibility, and improved employee health outcomes. As healthcare expenses continue to rise and traditional insurance models become increasingly unsustainable, self-funding offers a compelling alternative that aligns financial incentives with health improvement goals.

The benefits of self-insurance extend far beyond simple cost savings. By assuming direct financial responsibility for employee healthcare, organizations gain unprecedented visibility into utilization patterns, cost drivers, and clinical outcomes. This transparency enables data-driven decision-making that can transform healthcare from an unpredictable expense into a strategically managed investment in workforce health and productivity.

While self-funding isn’t appropriate for every organization, innovations in funding models, stop-loss protection, and administrative support have made these arrangements accessible to a broader range of employers than ever before. Even smaller organizations can now consider level-funded or partially self-insured approaches that deliver many self-funding advantages with reduced financial risk.

The key to successful self-insurance lies in thoughtful implementation, active management, and continuous optimization. Organizations that view self-funding as a long-term strategic approach rather than a quick-fix cost-cutting measure are best positioned to realize its full potential. By partnering with experienced administrators, implementing robust data analytics, and engaging employees as active healthcare consumers, employers can create sustainable health plans that deliver value for both the organization and its workforce.

As the healthcare landscape continues to evolve, self-insured plans offer the agility to adapt quickly to changing conditions, emerging treatments, and innovative delivery models. This flexibility, combined with the financial advantages and data insights inherent in self-funding, makes these arrangements an increasingly attractive option for forward-thinking organizations committed to providing high-quality, cost-effective healthcare benefits.

Whether you’re considering a transition to self-insurance or seeking to optimize an existing self-funded plan, the strategies outlined in this article provide a roadmap for maximizing the substantial benefits these arrangements can deliver. By embracing the principles of strategic plan design, data-driven decision-making, and active management, your organization can transform healthcare from a frustrating cost center into a valuable investment in organizational success.

References

- Kaiser Family Foundation. (2024). Employer Health Benefits Annual Survey. Retrieved from https://www.kff.org/health-costs/report/employer-health-benefits-annual-survey-archives/

- Health Insurance.org. (2024). What is a self-insured health plan? Retrieved from https://www.healthinsurance.org/glossary/self-insured-health-plan/

- PeopleKeep. (2023, December 28). Fully-insured vs. self-insured health plans. Retrieved from https://www.peoplekeep.com/blog/fully-insured-vs-self-insured-health-plans

- Verywell Health. (2024, November 9). What Is Self-Insured Health Insurance and How Is It Regulated? Retrieved from https://www.verywellhealth.com/what-is-self-insured-health-insurance-and-how-is-it-regulated-4688567

- Wikipedia. (2024). Self-funded health care. Retrieved from https://en.wikipedia.org/wiki/Self-funded_health_care

- Health Care Administrators Association. (2024). What is Self Funding? Retrieved from https://www.hcaa.org/page/selffunding

- Employee Benefits Security Administration. (2024). Health Plans & Benefits: ERISA. U.S. Department of Labor. Retrieved from https://www.dol.gov/agencies/ebsa/laws-and-regulations/laws/erisa

- Self-Insurance Institute of America. (2024). Self-Insured Group Health Plans. Retrieved from https://www.siia.org/page/self_insurance_101

- Society for Human Resource Management. (2024). Self-Insured Health Plans. Retrieved from https://www.shrm.org/resourcesandtools/tools-and-samples/toolkits/pages/selfinsuredhealthplans.aspx

- International Foundation of Employee Benefit Plans. (2023). Self-Funding Health Benefit Plans. Retrieved from https://www.ifebp.org/education/schedule/Pages/self-funding-health-benefit-plans.aspx