In today’s challenging economic landscape, employers face mounting pressure to provide competitive healthcare benefits while managing escalating costs. Traditional fully insured health plans continue to see premium increases that outpace inflation, creating significant financial strain for organizations of all sizes. According to a 2023 Kaiser Family Foundation survey, employer-sponsored health insurance premiums increased by 7% in 2023 alone, with family coverage now averaging nearly $24,000 annually.

A self funded healthcare trust represents a strategic departure from conventional insurance models. Rather than paying fixed premiums to an insurance carrier, employers establish a dedicated trust fund from which employee healthcare claims are paid directly. This approach transforms healthcare from a fixed expense to a variable cost that can be actively managed and optimized.

For organizations willing to assume a calculated level of financial risk, self funded healthcare trusts offer compelling advantages that we’ll explore throughout this guide.

What is a Self Funded Healthcare Trust?

A self funded healthcare trust is a financial arrangement in which an employer assumes direct responsibility for funding and paying employee healthcare claims rather than purchasing a traditional insurance policy. The employer establishes a trust—a separate legal entity—to hold funds designated for employee healthcare expenses. This trust serves as the funding mechanism through which medical claims are processed and paid.

The legal foundation for self funded healthcare trusts typically falls under the Employee Retirement Income Security Act (ERISA), which provides the regulatory framework governing employee benefit plans. This federal legislation establishes standards for plan management, fiduciary responsibilities, and participant protections.

Key components include: – Trust Fund: A dedicated account that holds employer contributions – Trust Document: Legal documentation establishing the trust’s purpose and structure – Trustees: Individuals responsible for managing the trust – Third-Party Administrator (TPA): An organization that processes claims and provides administrative services – Stop-Loss Insurance: Coverage that protects against catastrophic claims

How Self Funded Healthcare Trusts Work

Self funded healthcare trusts operate through a structured process:

- Trust Establishment: The employer creates a healthcare trust through legal documentation.

- Funding Strategy: Working with actuaries, the employer determines appropriate funding levels based on historical claims data and projected healthcare utilization.

- Trust Funding: The employer makes regular contributions to the trust fund, typically monthly.

- Employee Enrollment: Employees enroll in the healthcare plan, selecting coverage options similar to traditional insurance.

- Claims Processing: When employees receive medical services, providers submit claims to the third-party administrator.

- Claims Payment: Approved claims are paid directly from the trust fund.

- Financial Monitoring: Trustees continuously monitor claims experience and make adjustments to funding levels as needed.

- Stop-Loss Reimbursement: If claims exceed predetermined thresholds, the stop-loss carrier reimburses the trust for the excess amount.

Benefits of Implementing a Self Funded Healthcare Trust

Cost Savings

Self funded healthcare trusts offer significant cost savings potential:

- Elimination of Insurance Premium Tax: Self funded arrangements avoid the Insurance Premium Tax (generally around 3%) that applies to traditional insurance premiums, as noted by the Self-Insurance Institute of America.

- Retention of Surplus Funds: When claims experience is favorable, unused funds remain in the trust rather than becoming insurance company profits.

- Reduced Administrative Markup: Self funding eliminates insurance carrier profit margins, with employers paying only actual claims plus transparent administrative fees.

- Network Flexibility: Employers can negotiate directly with provider networks, potentially securing more favorable reimbursement rates.

- Improved Cash Flow: Self funded arrangements allow employers to maintain control of funds until claims are actually paid.

Enhanced Flexibility and Control

Self funded healthcare trusts provide employers with unprecedented control:

- Customizable Benefit Design: Employers can design plan benefits specifically tailored to their workforce’s needs.

- Plan Modification Agility: Changes to plan design can be implemented more quickly than with traditional insurance.

- Provider Network Selection: Employers can select provider networks that best serve their employee population.

Discover how customized healthcare plans can improve employee satisfaction and retention rates.

Data Access and Analytics

Self funding provides valuable insights:

- Detailed Claims Data: Employers gain access to comprehensive claims data, enabling deeper analysis of healthcare utilization patterns.

- Utilization Trends: Organizations can identify specific health conditions driving costs and develop targeted wellness programs.

- ROI Measurement: The effectiveness of wellness initiatives can be measured precisely through claims analysis.

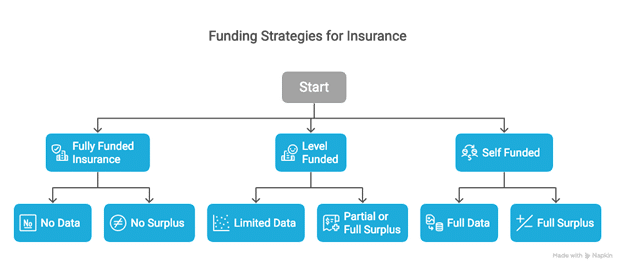

Types of Self Funded Healthcare Arrangements

| Arrangement Type | Structure | Best For | Risk Level |

|---|---|---|---|

| Standard Self Funded Trust | Employer establishes trust fund from which claims are paid directly | Medium to large employers with stable cash flow | Moderate to High |

| Partially Self Funded Plans | Employer assumes responsibility up to a threshold, with insurance covering catastrophic expenses | Small to medium-sized employers transitioning from fully insured | Low to Moderate |

| Multiple Employer Welfare Arrangements (MEWAs) | Multiple employers collectively establish a self funded plan | Small employers seeking advantages without full individual risk | Distributed |

Standard Self Funded Healthcare Trusts

- Structure: Employer establishes a trust fund from which claims are paid directly

- Best For: Medium to large employers with stable cash flow and predictable claims experience

Partially Self Funded Plans

- Structure: Employer assumes financial responsibility for claims up to a predetermined threshold, with traditional insurance covering catastrophic expenses

- Best For: Small to medium-sized employers transitioning from fully insured arrangements

Multiple Employer Welfare Arrangements (MEWAs)

- Structure: Multiple employers collectively establish a self funded plan

- Best For: Small employers seeking self funding advantages without assuming full individual risk

Setting Up a Self Funded Healthcare Trust

Initial Assessment and Feasibility Analysis

Before committing to self funding, organizations should conduct a thorough feasibility study:

- Claims Analysis: Review historical claims data to identify patterns and utilization trends.

- Financial Modeling: Project expected claims costs, administrative expenses, and stop-loss premiums.

- Risk Tolerance Evaluation: Assess the organization’s comfort with financial risk and determine appropriate stop-loss levels.

According to a 2023 Employee Benefits Research Institute study, organizations that conduct comprehensive feasibility analyses before implementing self funded plans are 68% more likely to achieve projected cost savings.

Legal Requirements and Documentation

Proper documentation is essential:

- Trust Agreement: Create a formal trust document that defines the trust’s purpose and structure.

- Plan Document: Develop a comprehensive plan document that details covered benefits and eligibility requirements.

Summary Plan Description (SPD): Prepare a clear summary of the plan for distribution to employees.

Selecting Service Providers

The success of a self funded healthcare trust depends significantly on the quality of its service providers:

- Trustee Selection: Appoint trustees responsible for overseeing the trust’s operations.

- Third-Party Administrator Selection: Choose a TPA with experience in self funded plan administration.

- Stop-Loss Carrier Selection: Select a financially stable stop-loss insurance provider.

Risk Management Strategies

Stop-Loss Insurance

Stop-loss insurance serves as the primary risk management tool:

- Specific (Individual) Stop-Loss: Protects against high claims from individual plan participants. When a single person’s claims exceed the specific deductible (typically $50,000 to $250,000), the stop-loss carrier reimburses the plan for the excess amount.

- Aggregate Stop-Loss: Protects against unexpectedly high total claims across the entire plan. If overall claims exceed a predetermined threshold (typically 125% of expected claims), the stop-loss carrier covers the excess.

Reserve Funding

Proper reserves provide financial stability:

- Incurred But Not Reported (IBNR) Reserves: Funds set aside for claims that have occurred but haven’t yet been submitted or processed.

- Catastrophic Reserves: Supplemental funds to cover the plan’s exposure up to the stop-loss deductible in case of large claims.

Cost Containment Programs

Numerous programs can help manage healthcare costs:

- Provider Network Optimization: Negotiating favorable reimbursement rates with high-quality providers.

- Reference-Based Pricing: Setting maximum payment levels for certain procedures.

- Pharmacy Benefit Management: Implementing formulary management and specialty pharmacy programs.

Learn more about advanced cost containment strategies for self-funded healthcare plans.

Challenges and Considerations

Financial Risk Exposure

The primary concern with self funding is the assumption of financial risk:

- Claim Volatility: Healthcare claims can fluctuate significantly from month to month.

- Catastrophic Claims: Organizations face exposure up to their specific deductible for high-cost cases.

- Mitigation Strategies: – Implement conservative funding based on actuarial projections – Purchase appropriate stop-loss coverage – Establish adequate reserves for claims fluctuations

Administrative Complexity

Self funding introduces administrative responsibilities:

- Vendor Management: Coordinating multiple vendors requires significant oversight.

- Compliance Obligations: ERISA, HIPAA, ACA, and other regulations impose substantial compliance requirements.

- Mitigation Strategies: – Assign dedicated staff with appropriate expertise – Consider outsourcing specialized functions to benefits consultants

Best Practices for Successful Implementation

Working with Experienced Advisors

Expert guidance is essential throughout the self funding journey:

- Benefits Consultants: Engage consultants with specific expertise in self funded arrangements.

- Legal Counsel: Work with attorneys specializing in ERISA and employee benefits.

- Actuarial Support: Utilize actuaries to develop appropriate funding levels and stop-loss strategies.

Data-Driven Decision Making

Leveraging data improves outcomes and cost management:

- Regular Claims Analysis: Review detailed claims reports monthly to identify trends and opportunities.

- Cost Driver Analysis: Identify the specific conditions and treatments driving healthcare costs.

Frequently Asked Questions

What size organization is suitable for a self funded healthcare trust?

While self funding was traditionally considered appropriate only for large employers (500+ employees), advances in stop-loss coverage and administrative options have made it viable for smaller organizations. The suitability depends not only on size but also on financial stability, risk tolerance, claims predictability, and administrative capabilities.

How much can employers save with a self funded approach?

Potential savings vary based on multiple factors, but typical ranges include: – First-Year Savings: 10-15% compared to comparable fully insured coverage – Long-Term Savings: 15-25% over a five-year period as data-driven improvements take effect.

What happens if claims exceed expectations?

When claims exceed projections, several mechanisms come into play: 1. Reserve Utilization: Initial reserves absorb some level of claims fluctuation. 2. Stop-Loss Coverage: If claims exceed predetermined thresholds, stop-loss insurance covers the excess. 3. Funding Adjustments: If claims consistently run higher than projected, the employer may need to increase contributions.

Conclusion

Self funded healthcare trusts represent a powerful alternative to traditional insurance arrangements for organizations seeking greater control over healthcare costs while maintaining quality benefits. The key advantages—cost savings, enhanced flexibility, and data access—make them increasingly attractive to employers of all sizes.

However, successful implementation requires careful planning, appropriate expertise, and ongoing management. Organizations must thoroughly assess their readiness, develop comprehensive implementation strategies, and establish robust governance structures.

With the right approach, self funded healthcare trusts can deliver meaningful advantages for both employers and employees in the complex world of healthcare benefits.