Tennessee’s legislation recently introduced a bill that could put a lot of money back into consumers’ pockets. SB 420/HB 870 proposes guidelines on member cost-sharing, as well as restrictions on insurers, pharmacy benefit managers (PBMs), and third-party administrators (TPAs). Anyone with an interest in what is going on in the insurance industry will want to keep an eye on the progress of this bill, but especially those HR, CFOs, CEOs, and other business leaders who care to know where their healthcare dollars are going. What will that look like for Tennessee companies? And what will it look like for other states or companies that might adopt similar strategies? Most importantly – what will it look like for employees?

What is Senate Bill 420/House Bill 870 (SB 420/HB 870)?

Tennessee Senator Shane Reeves and Representative Pat Rudder introduced a bill that will allow all amounts paid by insurance members or – and this part is important – others on their behalf to count toward their cost-sharing requirements, regardless of who makes those payments. In other words, even if a form of financial assistance is used (copay cards, manufacturer’s assistance program, etc.), those payments would still count toward the member’s out-of-pocket maximum.

The bill will also prohibit insurers, pharmacy benefit managers (PBMs), and third-party administrators (TPAs) from designing plan coverage based on the availability of financial or product assistance for prescription drugs. Currently, you might see a PBM create a formulary that drives members to medications that lean heavily on MAPs. If SB 420/HB 870 passes, that won’t be the case anymore.

And that means what, exactly?

Say you have an employee who currently takes a specialty medication that has no generic alternative and no biosimilars available. The medication itself costs $300 a month on the plan the employee is enrolled, and they simply can’t afford that (even though we know you offer a generous salary package). The good news is that the manufacturer has a copay assistance card – using that, the employee can get her medication for only $50 a month! That’s wonderful news! There’s a catch, though – that $50 a month doesn’t necessarily count toward the employee’s out-of-pocket max like a regular copay would. SB 420/HB 870 would change that.

Let’s look at an example:

| Expenses | Much sooner (reducing total cost for patient) | After HB 870 (Copay Counts Toward OOP Max) |

|---|---|---|

| Drug Cost | $1,000/month | $1,000/month |

| Copay Card Covers | $950 | $950 |

| Patient Pays | $50 | $50 |

| Amount Applied to Deductible/OOP Max | $0 (Insurer ignores assistance) | $1,000 (Insurer must count total cost) |

| When Deductible/OOP Max is Reached | Much later (if at all) | Much sooner (reducing total cost for patient) |

Another way that insurers, PBMs, and TPAs will be affected by this proposed legislation is that they won’t be able to build their plans and/or formularies in a way to specifically target drugs that will put more money back in their pockets. PBMs currently receive rebates from drug manufacturers for putting their medications on their formularies – but SB 420/HB 870 will prevent them from being able to do that and increase the transparency required in plan and formulary design.

The good, the bad, and the ugly for self-funding

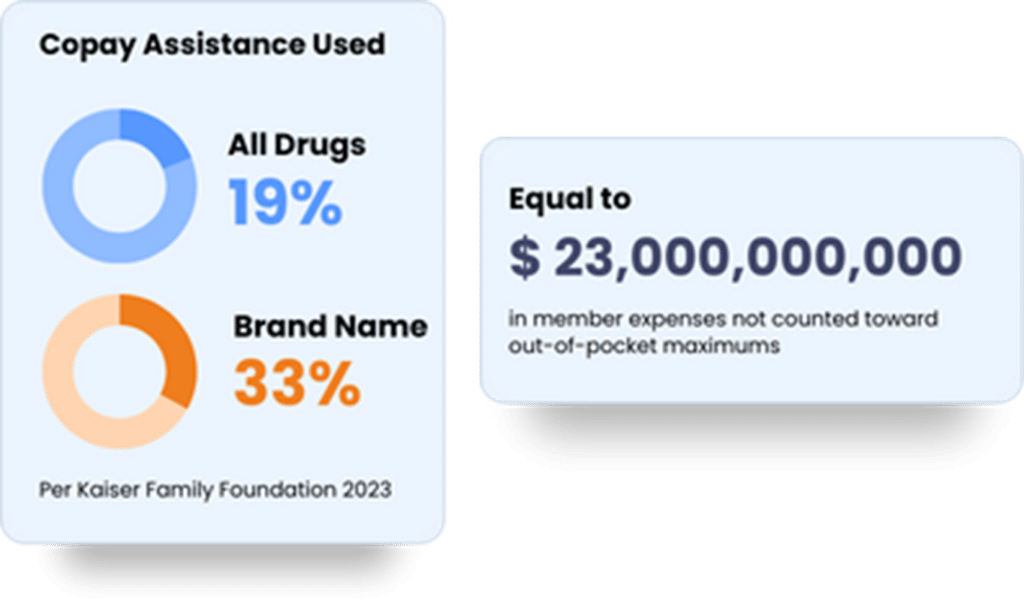

In the end, an employer is always trying walk that fine line between employee satisfaction and keeping an eye on the bottom line. Currently, 19% of all prescriptions filled in the United States with private insurance use a copay assistance program. The Kaiser Family Foundation estimates that value at about $23 billion. That means that $23 billion is not being counted towards out-of-pocket maximums around the country.

Plans governed by legislation like SB 420/HB 870 will likely see an increase in claims spend, though the overall amount will be close to negligible in the grand scheme of things. The reason for this is simple – with more payments counting toward their out-of-pocket maximums, employees will be meeting that cost sharing threshold sooner than they previously did.

Frequently Asked Questions

What is Tennessee SB 420/HB 870?

Tennessee SB 420/HB 870 is proposed legislation that will allow all money paid towards an insurance member’s care to count toward their cost-sharing thresholds.

Who does this bill impact?

This bill primarily impacts employers offering self-funded health plans, third-party administrators (TPAs), stop-loss insurance providers, and healthcare providers operating in Tennessee.

How does this bill affect self-funded health plans?

If SB 420/HB 870 passes, it could create new Tennessee health plan compliance requirements, reporting obligations, or state-level regulations pertaining to self-funded plan operations.

Will this bill increase costs for employers?

A lot will depend on the final version of the bill, but employers with self-funded strategies in place will likely see a slight increase in claims spend.

How does this legislation compare to federal ERISA regulations?

ERISA (Employee Retirement Income Security Act) generally preempts state laws governing self-funded plans. The introduction of SB 420/HB 870 could provide groundwork for some interesting conversation regarding the governing of self-funded plans.

What should employers and business owners do to prepare?

Employers and HR professionals should closely monitor the bill’s progress, assess potential impacts on their health plans, and consult with legal and benefits experts to ensure compliance and strategic adjustments if necessary.

When will this bill go into effect?

If passed, the bill’s effective date will depend on its final version and the legislative process. Employers should stay informed on implementation timelines.

Where can I find more information?

For the latest updates, visit the Tennessee General Assembly’s website or consult with industry experts such as the benefits consultants team at Ethos Benefits.