Are you evaluating health insurance options for your business? Understanding the differences between level funded and self funded health plans is crucial for making an informed decision that aligns with your company’s needs and financial objectives. Both funding models offer distinct advantages depending on your organization’s size, risk tolerance, and administrative capabilities.

Key Differences Between Level Funded and Self Funded Plans

Level funded and self funded health plans represent alternatives to traditional fully insured options, each with unique characteristics:

- Level funded plans combine predictable monthly payments with potential year-end refunds if claims are lower than expected

- Self funded plans offer maximum flexibility and potential cost savings, with employers directly funding claims as they occur

- With proper stop-loss insurance, both funding models provide equivalent risk protection against catastrophic claims

- Plan suitability varies based on employer size, administrative capabilities, and financial objectives

Both options can deliver significant advantages over traditional fully insured plans when implemented correctly.

What is a Level Funded Health Plan?

Level funded health plans represent a hybrid approach that combines elements of both fully insured and self funded models. These plans offer predictable monthly payments while providing the potential for savings if claims are lower than anticipated.

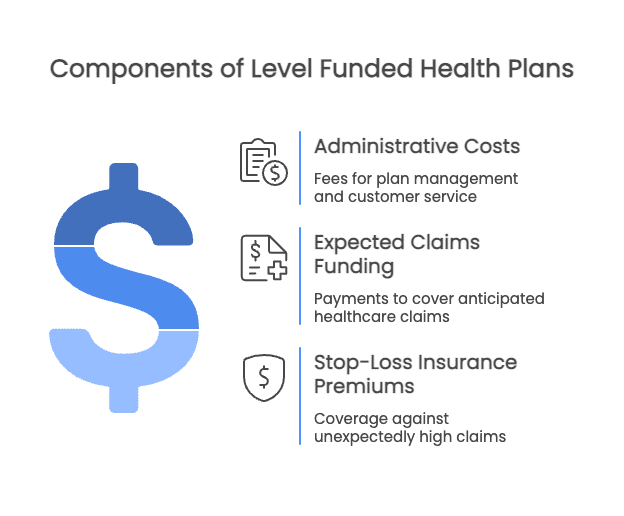

Structure and Components

In a level funded arrangement, employers pay a fixed monthly amount that typically includes:

- Administrative costs: Fees for plan management, claims processing, and customer service

- Expected claims funding: Payments to cover anticipated employee healthcare claims

- Stop-loss insurance premiums: Coverage that protects against unexpectedly high claims

The insurance carrier or third-party administrator (TPA) manages the plan, ensuring the employer’s risk is capped at a predetermined level. This structure provides budget predictability while offering potential financial benefits.

Benefits of Level Funded Plans

Level funded plans offer several advantages for employers:

- Predictable budgeting: Fixed monthly payments help with financial planning

- Potential savings: Unused claims funds may be partially returned at year-end

- Reduced risk exposure: Built-in stop-loss coverage limits financial liability

- Simplified administration: Carriers handle most administrative responsibilities

Regulatory flexibility: These plans may avoid certain ACA requirements that apply to fully insured plans

Limitations of Level Funded Plans

Despite their benefits, level funded plans have some limitations:

- Less flexibility: Fewer customization options compared to self funded plans

- Limited data access: Restricted claims data compared to self funded arrangements

- Potential for higher costs: Monthly payments may be higher than necessary to ensure carrier profitability

Less control: Carriers maintain significant control over plan design and administration

What is a Self Funded Health Plan?

Self funded health plans represent a funding approach where employers assume direct financial responsibility for employee healthcare claims rather than paying premiums to an insurance company.

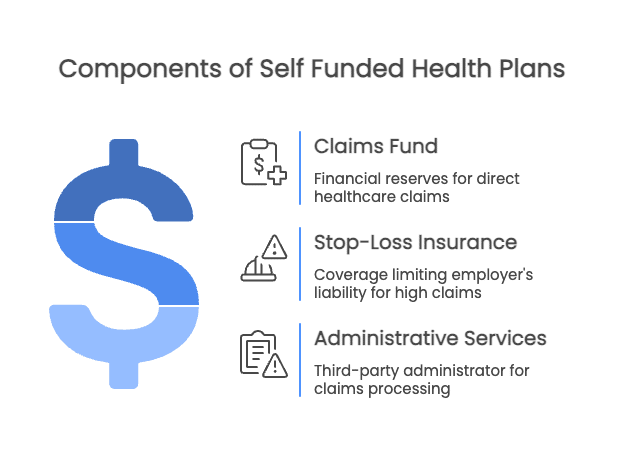

Structure and Components

In a self funded arrangement, employers typically establish:

- Claims fund: Financial reserves to pay employee healthcare claims directly

- Stop-loss insurance: Coverage that limits the employer’s liability for high claims

Administrative services: Third-party administrator (TPA) to process claims and manage the plan

Unlike level funded plans, self funded arrangements allow employers to pay claims as they occur rather than through fixed monthly payments. This provides greater flexibility but requires more sophisticated financial management.

Benefits of Self Funded Plans

Self funded plans offer numerous advantages:

- Maximum flexibility: Complete control over plan design and customization

- Potential cost savings: Direct payment of actual claims often costs less than premium payments

- Improved cash flow: Funds remain with the employer until claims are paid

- Comprehensive data access: Detailed claims information for better decision-making

Regulatory advantages: ERISA governance provides exemption from state insurance regulations and premium taxes

The Critical Role of Stop-Loss Insurance

Stop-loss insurance is essential to self funded plans and serves as the great equalizer in terms of risk management. With proper stop-loss coverage, self funded plans are not inherently riskier than level funded options.

Stop-loss insurance comes in two primary forms:

- Specific (individual) stop-loss: Protects against unexpectedly high claims from a single individual

- Aggregate stop-loss: Protects against higher-than-expected claims across the entire covered population

When properly structured, stop-loss coverage ensures that self funded employers face no more financial risk than those with level funded arrangements. The key difference is in how the risk is managed, not in the amount of risk exposure.

Comparing Level Funded and Self Funded Plans

When evaluating these funding models, several key factors should be considered:

Risk Management

Both level funded and self funded plans incorporate stop-loss insurance to protect against catastrophic claims. The primary difference lies in how this protection is structured:

- Level funded plans include built-in stop-loss coverage as part of the fixed monthly payment

- Self funded plans utilize customized stop-loss policies tailored to the employer’s specific risk tolerance

With proper stop-loss coverage in place, both funding models provide equivalent protection against unexpected high-cost claims. The notion that self funded plans are inherently riskier is a misconception when appropriate stop-loss insurance is implemented.

Cost Structure and Financial Implications

The cost structures of these plans differ significantly:

- Level funded plans feature predictable monthly payments with potential year-end refunds

- Self funded plans involve variable monthly expenses based on actual claims, with potential for immediate savings

While level funded plans offer budget certainty, self funded arrangements provide greater opportunity for cost savings. With proper financial planning and reserves, self funded plans can achieve both cost efficiency and predictability.

Administrative Considerations

The administrative requirements for each model vary considerably:

- Level funded plans typically include comprehensive administrative services from the carrier

- Self funded plans require partnerships with TPAs and more internal oversight

Employers must evaluate their administrative capabilities and preferences when choosing between these options. While self funded plans demand more administrative attention, they also provide greater control over the healthcare program.

Employer Size Considerations

Traditionally, funding models have been associated with specific employer sizes:

- Level funded plans were often recommended for small to mid-sized employers (25-100 employees)

- Self funded plans were typically suggested for larger organizations (100+ employees)

However, with advances in stop-loss products and administrative solutions, self funded arrangements have become viable options for smaller employers. When properly structured with appropriate stop-loss coverage, self funded plans can be suitable for organizations with as few as 25-50 employees.

Comparison Table: Level-Funded vs. Self-Funded Plans with Stop-Loss

| Feature | Level Funded Plan | Self Funded Plan |

|---|---|---|

| Monthly Cost | Fixed, predictable | Variable (based on actual claims) |

| Risk Exposure | Limited (built-in stop-loss) | Limited (customized stop-loss) |

| Plan Flexibility | Moderate | High – fully customizable |

| Claims Responsibility | Up to set threshold | Up to stop-loss attachment point |

| Regulatory Oversight | State regulated | ERISA (federal) |

| Data Access | Limited | Full claims transparency |

| Cost Savings | Refunds possible at year-end | Immediate if claims are low |

| Admin Complexity | Low – carrier handles most | High – more internal oversight |

| Best Fit For | Growing employers (25–100 employees) | Cost-savvy orgs (50+ employees) |

Note: With proper stop-loss coverage, self-funded plans can achieve risk levels equivalent to level-funded plans.

Making the Right Choice for Your Organization

When evaluating these funding models, several key factors should be considered:

Key Decision Factors

- Financial objectives: Prioritizing predictability vs. maximizing savings potential

- Risk tolerance: Comfort level with financial variability

- Administrative capabilities: Internal resources for plan management

- Data requirements: Need for detailed claims information

- Plan customization: Desired level of control over plan design

Implementation Considerations

Regardless of which model you choose, proper implementation is crucial:

- Stop-loss selection: Appropriate attachment points and coverage limits

- Network configuration: Provider networks that balance access and cost

- Plan design: Benefits structure that meets employee needs while managing costs

Vendor partnerships: Quality TPAs, brokers, and consultants

Frequently Asked Questions

Are self funded plans riskier than level funded plans?

No, not when proper stop-loss insurance is in place. With appropriate specific and aggregate stop-loss coverage, self funded plans can achieve risk levels equivalent to level funded arrangements. The key difference is in how the risk is managed, not in the amount of risk exposure.

Which funding model typically costs less?

Self funded plans generally offer greater potential for cost savings, as employers pay only for actual claims rather than predetermined premiums that include carrier profit margins. However, level funded plans provide more predictable budgeting and may include potential refunds if claims are lower than expected.

Can small employers benefit from self funding?

Yes, with proper stop-loss coverage and administrative support, self funded arrangements can be viable options for employers with as few as 25-50 employees. Advances in stop-loss products have made self funding increasingly accessible to smaller organizations.

How do these funding models impact employees?

From the employee perspective, there should be minimal difference between level funded and self funded plans. Both can offer similar benefits, networks, and member services. The primary differences relate to employer financing and administration rather than the employee experience.

What happens if claims exceed expectations?

In level funded plans, the built-in stop-loss coverage protects against unexpectedly high claims, maintaining the fixed monthly payment. In self funded plans, specific and aggregate stop-loss insurance limits the employer’s financial exposure once claims reach predetermined thresholds.

Can employers switch between funding models?

Yes, employers can transition between funding models, typically at renewal. Moving from level funded to self funded is relatively straightforward, while transitioning from self funded to level funded may require more adjustment due to differences in administrative structure.

Conclusion

Both level funded and self funded health plans offer viable alternatives to traditional fully insured arrangements, each with distinct advantages depending on your organization’s specific needs and objectives. With proper stop-loss insurance, self funded plans can achieve risk levels equivalent to level funded options while providing greater flexibility and potential cost savings.

The optimal choice depends on your organization’s unique circumstances, including size, financial objectives, risk tolerance, and administrative capabilities. By carefully evaluating these factors and implementing the selected model properly, employers can optimize their healthcare investment while providing valuable benefits to employees.

References

- PeopleKeep. (2024). “Level-Funded vs. Self-Funded Health Plans: What’s the Difference?” Retrieved from https://www.peoplekeep.com/blog/level-funded-vs.-self-funded-health-plans

- Roundstone Insurance. (2025). “Understanding Stop-Loss Insurance.” Retrieved from https://roundstoneinsurance.com/blog/understanding-stop-loss-insurance/

- IXSolutions. (2024). “Level Funded vs. Self Funded Health Insurance.” Retrieved from https://ixshealth.com/blog/level-funded-vs-self-funded/

- Self-Insurance Institute of America. (2024). “Stop-Loss Excess Insurance.” Retrieved from https://www.siia.org/i4a/pages/index.cfm?pageid=7535

- Fenwick. (2024). “The Shifting Regulatory Landscape for Level-Funded Plans.” Retrieved from https://www.fenwick.com/insights/publications/the-shifting-regulatory-landscape-for-level-funded-plans-an-alternative-for-group-health-insuranc