In today’s competitive business landscape, attracting and retaining top talent requires more than just competitive salaries. A well-designed employee benefits strategy has become a crucial differentiator for organizations looking to build engaged, productive teams. Whether you’re a small business owner or an HR professional at a large corporation, developing a strategic approach to employee benefits can significantly impact your company’s success.

The right benefits package communicates your organization’s values, supports employee wellbeing, and ultimately contributes to your bottom line. However, creating an effective employee benefits strategy requires careful planning, research, and implementation.

This comprehensive guide will walk you through the essential steps to develop a benefits strategy that aligns with your business objectives while meeting the diverse needs of your workforce. From understanding the fundamentals of employee benefits to avoiding common pitfalls, you’ll gain actionable insights to optimize your benefits offerings and maximize their impact

TL;DR

An effective employee benefits strategy requires understanding your workforce’s needs, aligning benefits with business objectives, and regular evaluation. Start by defining what benefits mean for your organization, establish clear goals and budget constraints, analyze employee demographics, and select benefits that provide the highest value. Implement a structured development process with regular feedback mechanisms, avoid common mistakes like one-size-fits-all approaches, and consider professional management for complex benefits administration. A well-executed strategy improves recruitment, retention, productivity, and overall business performance while supporting employee wellbeing.

What Are Employee Benefits?

Employee benefits are non-salary compensation provided to employees in addition to their regular wages or salaries. These offerings form a critical part of the total compensation package and serve multiple purposes for both employers and employees.

At their core, employee benefits can be divided into two main categories:

- Benefits: Non-wage compensation that covers expenses employees would typically need to pay from their salary, such as healthcare, retirement savings, and childcare.

- Perks: Additional incentives that enhance the employee experience but may not have a direct monetary value, such as flexible work arrangements, pet-friendly offices, or summer hours.

The distinction between benefits and perks is important when developing your strategy, as they serve different purposes and appeal to different employee needs.

Common Types of Employee Benefits

| Category | Examples | Primary Purpose |

|---|---|---|

|

Health & Wellness

|

Medical insurance, dental plans, vision coverage, wellness programs | Protect employee health and reduce financial burden of healthcare |

|

Financial Security

|

Retirement plans, life insurance, disability insurance, financial counseling | Provide long-term financial stability and protection |

|

Work-Life Balance

|

Paid time off, parental leave, flexible scheduling, remote work options | Support personal needs and prevent burnout |

|

Professional Development

|

Tuition assistance, training programs, conference attendance, mentorship | Enhance skills and career advancement |

|

Lifestyle

|

Commuter benefits, childcare assistance, pet insurance, employee discounts | Address daily needs and improve quality of life |

The specific mix of benefits offered varies widely across industries, company sizes, and geographic locations. What remains constant is that a thoughtfully designed benefits package communicates your organization’s values and commitment to employee wellbeing.

In today’s evolving workplace, benefits are increasingly viewed as a strategic tool rather than just a cost of doing business. Organizations that understand this shift gain a competitive advantage in attracting and retaining the talent they need to succeed.

Why Are Employee Benefits Important?

In today’s competitive job market, employee benefits have evolved from simple add-ons to essential components of an organization’s talent strategy. The importance of a well-designed benefits package extends far beyond basic compensation, directly impacting your company’s ability to attract, retain, and engage employees.

Impact on Recruitment and Retention

Recent statistics highlight the critical role benefits play in talent management:

- 78% of employees report they’re more likely to stay with an employer because of their benefits program

- 43% of employees have stated that their current benefits packages have kept them in their current roles

- The average annual turnover rate in the US is 47%, costing businesses approximately $1 trillion annually

- Replacing an employee typically costs between one-half to two times their annual salary

These numbers tell a compelling story: benefits are no longer optional but essential for maintaining a stable, experienced workforce. In an environment where inflation and salary increases often move at different rates (in 2022, the average salary increase was 3.4% while inflation hit 7.9%), benefits provide additional value that helps bridge this gap.

Benefits for Employers

A strategic benefits program delivers multiple advantages for organizations:

- Improved Recruitment: Attracts higher-quality candidates in a competitive market

- Enhanced Retention: Reduces costly turnover and preserves institutional knowledge

- Increased Productivity: Employees who feel supported are 20% more productive

- Strengthened Company Culture: Demonstrates organizational values and commitment to employee wellbeing

- Better Business Performance: Companies with great compensation and benefits see 56% lower turnover rates

- Tax Advantages: Many benefits offer tax incentives for employers

- Competitive Differentiation: Sets your organization apart from competitors, especially for small to medium-sized businesses

Benefits for Employees

For employees, a comprehensive benefits package provides:

- Financial Security: Protection against unexpected health costs and support for long-term financial planning

- Work-Life Balance: Resources to manage personal and professional responsibilities

- Health and Wellness Support: Access to preventive care and wellness programs that improve quality of life

- Career Development: Opportunities for growth and advancement

- Reduced Stress: Peace of mind knowing essential needs are covered

The data is clear: organizations that invest strategically in employee benefits create a win-win situation that supports both business objectives and employee wellbeing. As we’ll explore in the following sections, the key lies in developing a benefits strategy that aligns with your specific organizational needs and workforce demographics.

Benefits of a Robust Employee Benefits Strategy

A well-designed employee benefits strategy goes beyond simply offering a collection of perks. When strategically developed and implemented, a robust benefits strategy becomes a powerful business tool that delivers measurable advantages across multiple areas of your organization.

Organizational Impact of Strategic Benefits

Employee Experience Enhancement

A strategic approach to benefits significantly improves the employee experience in several key ways:

- Heightened Employee Satisfaction and Engagement: Employees who feel their needs are understood and addressed through thoughtful benefits show higher levels of job satisfaction and engagement. This translates to stronger commitment to organizational goals and a more positive workplace atmosphere.

- Improved Work-Life Balance: Benefits that support flexibility, family needs, and personal wellbeing help employees manage the demands of their professional and personal lives more effectively. This reduces stress and prevents burnout, leading to more sustainable performance.

- Enhanced Physical and Mental Wellbeing: Comprehensive health benefits that include mental health support, wellness programs, and preventive care contribute to healthier employees who experience fewer health-related absences and higher energy levels.

Greater Financial Security: Benefits that address both short-term financial needs and long-term financial planning provide employees with peace of mind that allows them to focus more fully on their work rather than financial worries.

Competitive Market Positioning

For small to medium-sized businesses (SMBs) in particular, a strategic benefits approach can level the playing field with larger competitors:

- Differentiation in Recruitment: When salary budgets are constrained, innovative benefits can make your organization stand out to top candidates.

- Enhanced Brand Reputation: A reputation for caring about employee wellbeing extends beyond your workforce to customers and the broader market.

- Adaptability to Market Changes: A well-designed strategy allows for flexibility to adjust benefits as market conditions and employee needs evolve.

The data clearly demonstrates that organizations with strategic benefits programs outperform those with ad hoc or minimal benefits offerings. By viewing benefits as an investment rather than simply a cost center, companies position themselves for stronger performance across all key business metrics.

Key Components of an Effective Employee Benefits Strategy

A successful employee benefits strategy isn’t created by chance—it requires thoughtful planning and integration of several critical components. Understanding these key elements will help you build a framework that delivers value to both your organization and your employees.

Strategic Alignment with Business Objectives

The foundation of any effective benefits strategy is alignment with your organization’s broader business goals. This ensures that your benefits investments support rather than detract from your company’s direction.

| Business Objective | Benefits Strategy Alignment |

|---|---|

|

Growth & Expansion

| Benefits that attract new talent and support workforce scaling |

|

Innovation

| Programs that encourage creativity, learning, and skill development |

|

Cost Optimization

| Value-focused benefits with measurable ROI and cost containment features |

|

Stability & Retention

| Long-term incentives that reward loyalty and institutional knowledge |

|

Market Differentiation

| Unique benefits that reflect your brand and company culture |

Comprehensive Needs Assessment

Understanding the specific needs of your workforce is essential for creating a benefits package that resonates with employees. This requires:

- Demographic Analysis: Examining the age, family status, career stage, and other characteristics of your employee population

- Employee Feedback: Gathering direct input through surveys, focus groups, and other feedback mechanisms

- Utilization Review: For existing benefits, analyzing which offerings are being used and to what extent

Competitive Benchmarking: Understanding what comparable organizations in your industry and region are offering

Clear Governance Structure

Effective benefits management requires defined roles, responsibilities, and decision-making processes:

- Executive Sponsorship: Senior leadership support and alignment

- Cross-Functional Input: Perspectives from finance, operations, and other departments

- Implementation Team: Dedicated resources for program execution

- Ongoing Oversight: Committee or team responsible for monitoring and adjustments

Data-Driven Decision Framework

Making benefits decisions based on concrete data rather than assumptions leads to better outcomes:

Data-Driven Benefits Decision Framework

1. Collect & Analyze Data

- Employee demographics

- Utilization patterns

- Cost trends

- Satisfaction metrics

2. Identify Gaps & Needs

- Unmet employee needs

- Competitive gaps

- Cost inefficiencies

- Compliance risks

3. Develop Strategic Options

- Benefit modifications

- New offerings

- Cost containment

- Communication improvements

4. Evaluate & Select

- Cost-benefit analysis

- Alignment with objectives

- Implementation feasibility

- Employee impact

5. Implement & Monitor

- Execution plan

- Communication strategy

- Utilization tracking

- Feedback collection

A strategic approach to benefits decisions leads to better outcomes for both employees and the organization.

Flexible and Inclusive Design

Modern benefits strategies recognize the diversity of employee needs and preferences:

- Tiered Options: Different levels of coverage or participation to accommodate various needs

- Customization: Allowing employees to allocate resources to benefits that matter most to them

- Inclusivity: Ensuring benefits are accessible and valuable to all employee groups

Adaptability: Building in mechanisms to evolve as workforce demographics change

Effective Communication Plan

Even the best benefits program will fall short if employees don’t understand or appreciate what’s available:

- Multi-Channel Approach: Using various communication methods to reach all employees

- Clear Messaging: Explaining benefits in simple, accessible language

- Ongoing Education: Regular reminders and updates about available benefits

- Decision Support: Tools and resources to help employees make informed choices

Compliance and Risk Management

A robust benefits strategy must address legal requirements and potential liabilities:

- Regulatory Compliance: Ensuring all benefits meet applicable laws and regulations

- Documentation: Maintaining proper records and disclosures

- Risk Assessment: Identifying and mitigating potential compliance issues

- Regular Audits: Reviewing programs to ensure ongoing compliance

By incorporating these key components into your benefits strategy, you create a solid foundation for a program that delivers value, remains sustainable, and adapts to changing needs over time.

How to Develop an Employee Benefits Strategy

Creating an effective employee benefits strategy requires a systematic approach. By following these seven steps, you can develop a benefits program that aligns with your business objectives while meeting employee needs.

Step 1: Align with Your Business Strategy

Your benefits strategy should directly support your organization’s long-term business goals. Begin by examining your company’s mission, vision, and strategic objectives.

Key Actions:

- Review your organization’s business strategy and identify how benefits can support key priorities

- Determine how benefits can address specific business challenges (talent shortages, high turnover, etc.)

- Establish clear connections between benefits investments and expected business outcomes

- Involve executive leadership to ensure alignment and support

For example, if your business strategy includes expanding into new markets, your benefits strategy might focus on offerings that attract diverse talent or support relocation. If innovation is a priority, consider benefits that encourage continuous learning and creative thinking.

Step 2: Set Clear Objectives and Budget Parameters

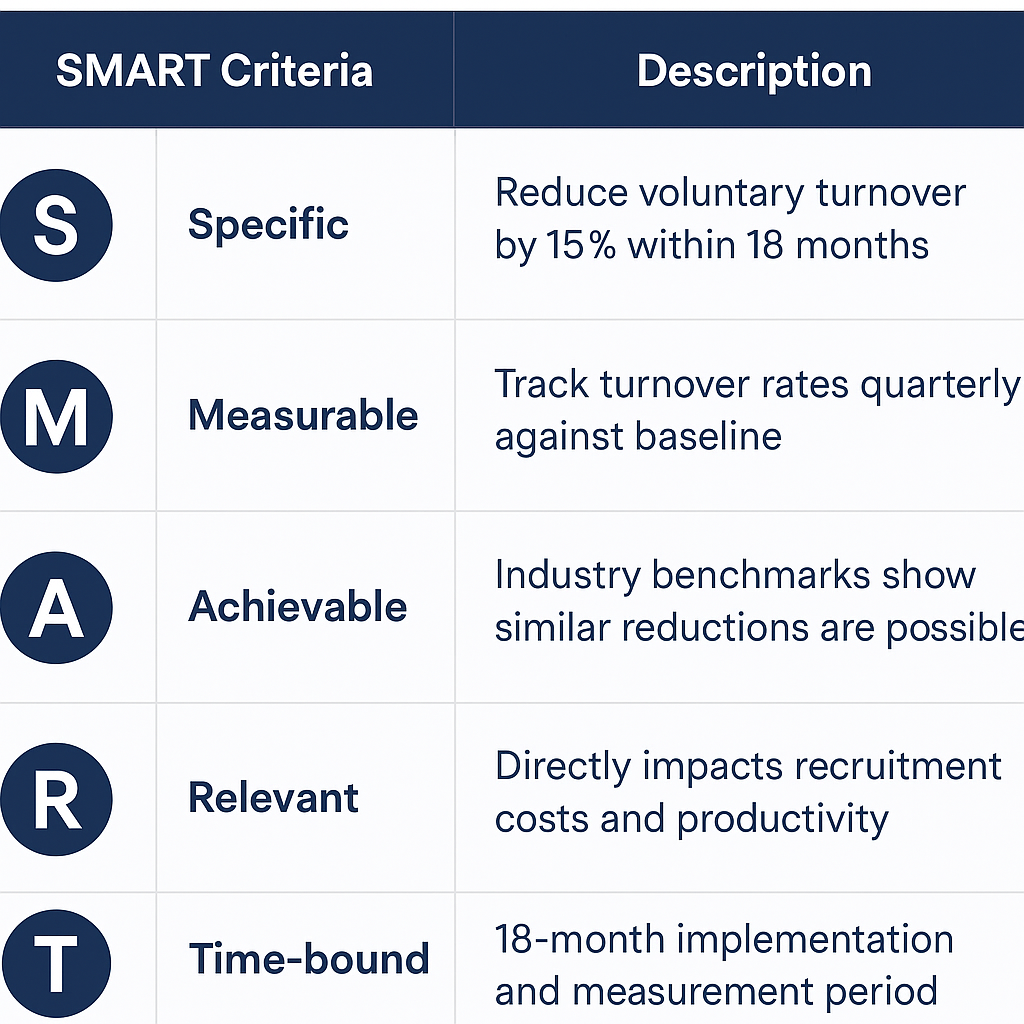

Establish specific, measurable goals for your benefits program and determine budget constraints.

SMART Goals Example:

Budget Considerations:

- Analyze current benefits spending as a percentage of total compensation

- Research industry benchmarks for benefits investments

- Consider both direct costs and administrative expenses

- Build in contingencies for unexpected cost increases

- Determine ROI metrics to evaluate benefits investments

According to the Bureau of Labor Statistics, benefits typically account for 30-40% of total compensation costs. Understanding this benchmark helps set realistic budget expectations.

Step 3: Analyze Your Workforce Demographics and Needs

A deep understanding of your employee population is essential for designing relevant benefits.

Demographic Analysis Factors:

- Age distribution and generational preferences

- Family status and caregiving responsibilities

- Geographic location and regional considerations

- Job roles, income levels, and career stages

- Cultural and diversity factors

Data Collection Methods:

- Employee surveys and focus groups

- Exit interview insights

- Utilization data from current benefits

- Industry benchmarking studies

- One-on-one conversations with team members

Different employee segments have distinct priorities. For instance, younger employees often value student loan assistance and professional development, while employees with families may prioritize comprehensive health coverage and flexible scheduling.

Step 4: Design Your Benefits Package

Based on your analysis, create a benefits package that balances employee needs with organizational constraints.

Core Benefits Categories:

| Category | Traditional Benefits | Emerging Trends |

|---|---|---|

|

Health & Wellness

|

Medical, dental, vision insurance | Mental health support, telehealth, fitness programs |

|

Financial Security

|

Retirement plans, life insurance | Financial wellness programs, student loan assistance |

|

Work-Life Balance

|

Paid time off, parental leave | Flexible scheduling, remote work options |

|

Professional Growth

|

Tuition reimbursement | Learning stipends, mentorship programs |

|

Workplace Experience

|

Office amenities | Remote work stipends, collaborative tools |

Design Principles:

- Prioritize benefits with the highest perceived value relative to cost

- Consider a tiered approach with core and optional benefits

- Build in flexibility to accommodate diverse needs

- Ensure equity across different employee groups

- Balance immediate needs with long-term objectives

Step 5: Develop an Implementation Plan

A thoughtful implementation strategy ensures smooth rollout and adoption.

Implementation Timeline:

- Planning Phase (2-3 months): Finalize selections, prepare documentation, develop communication materials

- Pre-Launch (1 month): Train HR team and managers, set up administrative systems

- Launch (2-4 weeks): Announce program, conduct education sessions, open enrollment period

- Post-Launch (Ongoing): Gather feedback, address issues, monitor utilization

Key Implementation Considerations:

- Vendor selection and management

- Technology and administrative systems

- Legal compliance and documentation

- Manager training and support

- Change management strategies

Step 6: Create a Comprehensive Communication Strategy

Effective communication is critical to benefits program success.

Communication Best Practices:

- Use multiple channels (email, intranet, meetings, videos)

- Tailor messages to different employee segments

- Focus on value and relevance, not just features

- Provide decision-making tools and resources

- Maintain year-round communication, not just during enrollment

- Collect feedback on communication effectiveness

Research shows that employees who understand their benefits are 2.5 times more likely to be satisfied with them, regardless of what’s actually offered.

| Metric | Before Communication Training | After Communication Training | Improvement |

|---|---|---|---|

|

Understand Benefits

|

35% | 78% | +43% |

|

Value Benefits

|

42% | 85% | +43% |

|

Utilize Benefits

|

28% | 72% | +44% |

|

Recommend Benefits

|

31% | 68% | +37% |

Effective communication significantly increases employee understanding and utilization of benefits.

Step 7: Establish Evaluation and Refinement Processes

Regular assessment ensures your benefits strategy remains effective and relevant.

Key Performance Indicators:

- Utilization rates for different benefits

- Employee satisfaction and feedback

- Recruitment and retention metrics

- Cost trends and ROI analysis

- Administrative efficiency

Review Cadence:

- Quarterly: Utilization and cost tracking

- Annually: Comprehensive program review

- Every 2-3 Years: Full strategic reassessment

Benefits Strategy Review Timeline

Quarterly Review

Focus: Utilization and cost tracking

- Track utilization metrics

- Monitor costs vs. budget

- Address emerging issues

Annual Review

Focus: Comprehensive program assessment

- Evaluate program effectiveness

- Assess employee satisfaction

- Benchmark against competitors

- Plan for upcoming year

Bi-Annual Strategic Review

Focus: Full strategic reassessment

- Reassess alignment with business goals

- Evaluate long-term sustainability

- Consider major program changes

Triggered Reviews

Focus: Major business or regulatory changes

Triggers:

- Merger or acquisition activity

- Major regulatory changes

- Significant workforce shifts

- Budget constraints

Regular reviews ensure your benefits strategy remains aligned with business objectives and employee needs.

By following these seven steps, you’ll create a benefits strategy that serves as a powerful tool for achieving business objectives while supporting employee wellbeing and satisfaction. Remember that benefits strategy development is not a one-time event but an ongoing process that evolves with your organization and workforce.

Common Mistakes to Avoid in Employee Benefits Strategies

Even well-intentioned organizations can undermine their benefits programs through common missteps. Being aware of these pitfalls can help you develop a more effective strategy and maximize your return on investment.

1. One-Size-Fits-All Approach

Perhaps the most prevalent mistake is failing to recognize the diversity of your workforce and their varying needs.

Why It Happens:

- Simplicity of administration

- Perceived fairness in offering identical benefits

- Lack of demographic analysis

The Impact:

- Low utilization of benefits that don’t match employee needs

- Reduced perceived value despite significant investment

- Missed opportunity to address specific employee segments

Solution:

Implement a flexible benefits approach that allows customization while maintaining equity. Conduct regular needs assessments and segment your workforce to understand varying priorities across different employee groups.

2. Inadequate Communication and Education

Even the most generous benefits package will fall short if employees don’t understand what’s available or how to access it.

Why It Happens:

- Overreliance on annual enrollment periods for communication

- Complex benefit descriptions filled with jargon

- Insufficient resources dedicated to benefits education

- Using a single communication channel

Solution:

Develop a year-round, multi-channel communication strategy that explains benefits in simple terms. Create decision support tools, provide regular reminders, and offer personalized guidance to help employees maximize their benefits.

3. Chasing Trends Without Strategic Alignment

Adding trendy benefits without considering their alignment with your business objectives and employee needs wastes resources and creates confusion.

Why It Happens:

- Competitive pressure to match other employers

- Reaction to isolated employee requests

- Desire to appear innovative

The Impact:

- Scattered, unfocused benefits portfolio

- Difficulty measuring effectiveness

- Increased administrative burden

Solution:

Evaluate all potential benefits against your strategic objectives and employee needs. Implement new benefits only when they align with your overall strategy and can demonstrate clear value.

4. Neglecting Compliance and Legal Requirements

Benefits administration involves complex regulatory requirements that vary by location and benefit type.

Common Compliance Failures:

- Inadequate documentation and record-keeping

- Missing required notices and disclosures

- Inconsistent application of eligibility rules

- Failure to update plans for regulatory changes

Solution:

Establish robust compliance processes, conduct regular audits, and consider working with benefits professionals who stay current on regulatory requirements. Document all policies and procedures thoroughly.

5. Insufficient Measurement and Evaluation

Without proper metrics, it’s impossible to determine if your benefits strategy is delivering the intended results.

Why It Happens:

- Difficulty in establishing clear metrics

- Lack of baseline data

- Inadequate tracking systems

- Focus on implementation rather than outcomes

Solution:

Establish key performance indicators tied to your strategic objectives. Regularly collect and analyze data on utilization, satisfaction, cost, and impact on business outcomes. Use this information to refine your approach.

6. Overlooking Total Compensation Perspective

Benefits should be considered as part of a holistic compensation strategy rather than in isolation.

Why It Happens:

- Siloed HR functions

- Separate budgeting processes

- Different decision-makers for various compensation elements

Solution:

Develop an integrated total compensation philosophy that considers how benefits, base pay, variable compensation, and non-financial rewards work together. Communicate the full value of this package to employees.

7. Failing to Adapt to Changing Needs

A static benefits strategy quickly becomes outdated as workforce demographics, business conditions, and employee expectations evolve.

Warning Signs of an Outdated Strategy:

- Declining utilization rates

- Increasing employee dissatisfaction

- Rising costs without corresponding value

- Benefits that don’t align with current workforce demographics

Solution:

Build regular review cycles into your benefits strategy. Stay attuned to workforce trends, competitive offerings, and changing employee needs. Be willing to phase out benefits that no longer deliver value and introduce new ones that better align with current priorities.

By avoiding these common pitfalls, you can develop a more effective benefits strategy that delivers value to both your organization and your employees while making the most efficient use of your resources.

Why You Should Hire Professionals to Manage Employee Benefits

As organizations grow and benefits programs become more complex, many companies find value in partnering with professional benefits management services. Understanding when and why to engage these specialists can significantly impact your benefits strategy’s effectiveness and efficiency.

The Complexity Challenge

Managing employee benefits has grown increasingly complex due to several factors:

| Complexity Factor | Impact on Benefits Management |

|---|---|

|

Regulatory Environment

|

Constantly evolving laws and compliance requirements at federal, state, and local levels |

|

Benefits Diversity

|

Expanding array of benefit types requiring specialized knowledge |

|

Administrative Burden

|

Time-consuming processes for enrollment, changes, and claims management |

|

Cost Management

|

Sophisticated approaches needed to control rising healthcare and benefits costs |

|

Technology Integration

|

Complex systems for benefits administration and employee self-service |

|

Data Security

|

Heightened requirements for protecting sensitive employee information |

For many organizations, especially small to medium-sized businesses, keeping pace with these complexities while focusing on core business functions presents a significant challenge.

Advantages of Professional Benefits Management

Working with benefits professionals—whether through consultants, brokers, Professional Employer Organizations (PEOs), or dedicated benefits administration firms—offers numerous advantages:

1. Specialized Expertise and Market Knowledge

Benefits professionals bring deep expertise that most organizations cannot maintain internally:

- Industry-Specific Knowledge: Understanding of benefits trends and best practices in your sector

- Vendor Relationships: Established connections with insurance carriers and benefits providers

- Benchmarking Data: Access to competitive information about what similar organizations offer

- Compliance Expertise: Up-to-date knowledge of complex regulatory requirements

2. Cost Optimization and Efficiency

Professional benefits management often delivers significant financial advantages:

Cost Savings Through Professional Benefits Management

| Expense Category | Percentage Reduction |

|---|---|

| Compliance Penalties |

95%

95%

|

| HR Staff Time |

42%

42%

|

| Administrative Costs |

28%

28%

|

| Overall Benefits Spend |

18%

18%

|

| Healthcare Premiums |

15%

15%

|

Professional benefits management delivers significant cost savings across multiple expense categories.

- Negotiating Power: Ability to secure better rates through collective purchasing or expertise

- Plan Design Optimization: Strategic adjustments that maintain value while controlling costs

- Administrative Efficiency: Streamlined processes that reduce internal workload

- Technology Leverage: Access to sophisticated benefits platforms without capital investment

3. Enhanced Employee Experience

Professional management can significantly improve how employees interact with and perceive their benefits:

- Simplified Enrollment: User-friendly systems that make selection and enrollment easier

- Educational Resources: Better communication tools and resources to help employees understand their options

- Personalized Support: Access to benefits experts who can answer questions and provide guidance

- Consistent Service: Reliable, professional handling of benefits issues and questions

4. Risk Mitigation and Compliance

One of the most valuable aspects of professional benefits management is protection from compliance-related risks:

- Regulatory Monitoring: Continuous tracking of changing laws and requirements

- Documentation Management: Proper maintenance of required records and notices

- Audit Preparation: Systems and processes that withstand regulatory scrutiny

- Error Reduction: Decreased likelihood of costly administrative mistakes

When to Consider Professional Management

Several indicators suggest it might be time to engage benefits professionals:

- Growing Complexity: Your benefits program has expanded beyond what your internal team can effectively manage

- Compliance Concerns: You’re struggling to keep up with regulatory requirements

- Rising Costs: Benefits expenses are increasing faster than your budget

- Administrative Burden: Your HR team spends excessive time on benefits administration

- Employee Dissatisfaction: Feedback indicates confusion or frustration with current benefits processes

- Strategic Focus: You want your HR team to focus on strategic initiatives rather than administrative tasks

Selecting the Right Professional Partner

If you decide to pursue professional benefits management, consider these factors when selecting a partner:

- Service Model Alignment: Ensure their approach matches your organization’s needs and culture

- Industry Experience: Look for expertise with organizations similar to yours

- Technology Capabilities: Evaluate their systems for compatibility and user-friendliness

- Service Team: Understand who will manage your account and their accessibility

- References: Speak with current clients about their experiences

- Value Proposition: Focus on total value delivered, not just fees

Professional benefits management represents a strategic investment that can deliver significant returns through improved efficiency, better employee experiences, and optimized benefits spending. For many organizations, particularly those with limited internal HR resources, this partnership provides a valuable competitive advantage in the quest to attract and retain top talent.

Frequently Asked Questions (FAQs)

What is the Difference Between Mandatory and Voluntary Benefits?

Mandatory benefits are those required by law for employers to provide. These typically include:

- Social Security and Medicare contributions

- Unemployment insurance

- Workers’ compensation insurance

- Family and Medical Leave (for eligible employers)

- Health insurance (for employers with 50+ full-time employees under the ACA)

Voluntary benefits are additional offerings employers choose to provide beyond legal requirements. These may include:

- Dental and vision insurance

- Life and disability insurance

- Retirement plans

- Paid time off

- Wellness programs

- Professional development opportunities

- Various lifestyle benefits

The key distinction is that mandatory benefits must be provided to comply with legal requirements, while voluntary benefits are strategic choices made by employers to attract and retain talent, enhance employee wellbeing, and support business objectives.

What Are Some Low-Cost Benefits That Still Provide High Value?

Not all impactful benefits require significant financial investment. Here are several low-cost options that employees often highly value:

| Benefit | Implementation Cost | Perceived Value | Why It Works |

|---|---|---|---|

|

Flexible Work Arrangements

|

Low | Very High | Offers autonomy and work-life balance without direct costs |

|

Recognition Programs

|

Low-Moderate | High | Satisfies fundamental need for appreciation and acknowledgment |

|

Professional Development

|

Moderate | High | Demonstrates investment in employee growth and future |

|

Wellness Initiatives

|

Low-Moderate | High | Shows concern for employee wellbeing beyond work |

|

Extra Time Off

|

Varies | Very High | Provides valuable personal time with manageable business impact |

|

Remote Work Options

|

Low-Moderate | Very High | Eliminates commuting costs and enhances flexibility |

|

Casual Dress Code

|

None | Moderate | Creates more comfortable work environment at no cost |

|

Employee Discounts

|

Low | Moderate | Leverages business relationships for employee savings |

When implementing low-cost benefits, consider these best practices:

- Focus on what employees actually want rather than what’s easiest to implement

- Communicate the value effectively so employees understand and appreciate the offering

- Ensure consistent application across all eligible employee groups

- Measure utilization and satisfaction to refine offerings over time

How Often Should an Employee Benefits Strategy Be Reviewed?

A benefits strategy should be reviewed on multiple timelines to ensure it remains effective and relevant:

Factors that might necessitate more frequent reviews include:

- Rapidly changing industry conditions

- Significant shifts in workforce demographics

- Major regulatory changes affecting benefits

- Merger or acquisition activity

- Feedback indicating employee dissatisfaction

- Unexpected cost increases

The review process should involve multiple stakeholders, including:

- HR and benefits professionals

- Finance team members

- Executive leadership

- Employee representatives

- Benefits consultants or brokers (if applicable)

Regular reviews ensure your benefits strategy remains aligned with both business objectives and employee needs while controlling costs and maintaining competitive positioning in the talent market.

Conclusion

Developing an effective employee benefits strategy is no longer optional for organizations that want to thrive in today’s competitive business environment. As we’ve explored throughout this article, a well-designed benefits program serves as a powerful tool for attracting top talent, improving retention, enhancing productivity, and ultimately driving business success.

The most successful benefits strategies share several key characteristics: they align closely with business objectives, respond to employee needs, adapt to changing conditions, and deliver measurable value. By following the seven-step process outlined in this guide and avoiding common pitfalls, you can create a benefits program that works for both your organization and your employees.

Remember that benefits strategy development is not a one-time event but an ongoing process. Regular evaluation and refinement ensure your program remains relevant and effective as your workforce, business conditions, and competitive landscape evolve.

Whether you manage benefits internally or partner with professional services, the investment in a thoughtful, strategic approach to employee benefits will pay dividends through improved recruitment outcomes, stronger employee engagement, and enhanced organizational performance.

By viewing benefits as a strategic business tool rather than simply a cost center, you position your organization to build the workforce you need to achieve your goals while supporting the wellbeing and satisfaction of the employees who make your success possible.

References

- Bureau of Labor Statistics. (2023). “Employer Costs for Employee Compensation.” U.S. Department of Labor. https://www.bls.gov/news.release/ecec.toc.htm

- Society for Human Resource Management (SHRM). (2023). “How to Design an Employee Benefits Program.” https://www.shrm.org/topics-tools/news/benefits-compensation/how-to-design-employee-benefits-program

- TriNet. (2023). “Impact of Employee Benefits on Recruitment and Retention.” https://www.trinet.com/insights/impact-of-employee-benefits-on-recruitment-and-retention

- Academy to Innovate HR (AIHR). (2023). “Employee Benefits Strategy: A Complete Guide.” https://www.aihr.com/blog/employee-benefits-strategy/

- MetLife. (2022). “Employee Benefit Trends Study.” https://www.metlife.com/employee-benefit-trends/

- Willis Towers Watson. (2023). “Global Benefits Attitudes Survey.” https://www.wtwco.com/en-US/Insights/trending-topics/global-benefits-attitudes-survey

- Gallup. (2022). “State of the American Workplace Report.” https://www.gallup.com/workplace/238085/state-american-workplace-report-2017.aspx

- Harvard Business Review. (2022). “The Real Value of Employee Benefits.” https://hbr.org/topic/employee-retention

- Mercer. (2023). “Global Talent Trends Study.” https://www.mercer.com/our-thinking/career/global-talent-hr-trends.html

- International Foundation of Employee Benefit Plans. (2023). “Employee Benefits Survey.” https://www.ifebp.org/store/Pages/employee-benefits-survey.aspx

- Deloitte. (2023). “Global Human Capital Trends.” https://www2.deloitte.com/us/en/insights/focus/human-capital-trends.html

- PwC. (2023). “Employee Financial Wellness Survey.” https://www.pwc.com/us/en/services/consulting/workforce-of-the-future/library/employee-financial-wellness-survey.html

- Kaiser Family Foundation. (2023). “Employer Health Benefits Survey.” https://www.kff.org/health-costs/report/employer-health-benefits-annual-survey-archives/

- Glassdoor. (2022). “Employment Confidence Survey.” https://www.glassdoor.com/research/

- American Psychological Association. (2023). “Work and Well-being Survey.” https://www.apa.org/news/press/releases/stress/index

- WorldatWork. (2023). “Total Rewards and Employee Well-Being Practices.” https://worldatwork.org/resources/surveys

- Aflac. (2022). “WorkForces Report.” https://www.aflac.com/business/resources/aflac-workforces-report/default.aspx

- Paychex. (2023). “Pulse of HR Survey.” https://www.paychex.com/articles/human-resources/pulse-of-hr-survey

- Aon. (2023). “Benefits and Trends Survey.” https://www.aon.com/getmedia/0f6fe408-376f-4c12-aeae-a7aff6fbea9a/aon-benefits-and-trends-survey-2023.pdf

- 20. Fidelity Investments. (2023). “Workplace Benefits Report.” https://sponsor.fidelity.com/bin-public/06_PSW_Website/documents/Building_Financial_Futures.pdf