Have you ever wondered, “What is an ERISA bond, and why does it matter for employee benefit plans?” If you’re involved in managing or overseeing retirement plans, or health and welfare plans, understanding ERISA bonds isn’t just helpful—it’s crucial. The Employee Retirement Income Security Act (ERISA) of 1974 brought about significant changes to protect the hard-earned benefits of employees, and one of its key provisions is the requirement for a fidelity bond. As a team dedicated to demystifying complex financial and regulatory topics, we’re here to guide you through everything you need to know about ERISA bonds. In this comprehensive guide, you’ll discover what an ERISA bond is, why it’s a necessary safeguard, who needs one, the specific legal requirements, and how it ultimately protects the assets of retirement plans from potential fraud and dishonesty. We’ll break down the essentials in a clear, personable way, ensuring you walk away with a solid understanding of this important financial instrument.

ERISA Bonds Explained Quickly

An ERISA bond is a type of insurance mandated by the Employee Retirement Income Security Act (ERISA) to protect employee benefit plans (like 401(k)s and many health and welfare plans) from losses due to fraud or dishonesty by those who handle plan funds. This guide explains what an ERISA bond is, why it’s crucial for safeguarding plan assets, who needs to be bonded, the specific legal requirements for coverage amounts (generally 10% of funds handled, with a $1,000 minimum and $500,000 maximum, or $1 million for plans with employer securities), and how these bonds function to reimburse the plan in case of theft or embezzlement. It also distinguishes ERISA bonds from fiduciary liability insurance and outlines the steps to acquire one.

What Is an ERISA Bond?

At its core, an ERISA bond is a specific type of insurance policy designed to protect employee benefit plans from losses due to fraud or dishonesty by the people who handle plan funds or other property. Think of it as a safety net for the plan itself. The Employee Retirement Income Security Act (ERISA) mandates this type of bond to safeguard the financial integrity of these plans. According to the U.S. Department of Labor, an ERISA fidelity bond specifically covers losses resulting from acts like larceny, theft, embezzlement, forgery, misappropriation, wrongful abstraction, wrongful conversion, and willful misapplication. It’s important to understand that this bond is not the same as fiduciary liability insurance, which covers breaches of fiduciary duties (like mismanagement or imprudent investment decisions) rather than outright theft or dishonesty. The U.S. Department of Labor explains that an ERISA section 412 bond (sometimes referred to as an ERISA fidelity bond) has the primary purpose of reimbursing the plan for assets lost due to fraud or dishonesty. U.S. Department of Labor guidance explains that this bond is a key risk management tool specifically structured to meet ERISA’s stringent requirements, ensuring that if a plan fiduciary or anyone handling plan assets acts dishonestly, the plan can recover those losses up to the bond’s coverage limit.

Who Needs an ERISA Bond?

Determining who needs an ERISA bond is a critical aspect of compliance. The short answer, as per ERISA Section 412 and reiterated by the U.S. Department of Labor, is that “every fiduciary of an employee benefit plan and every person who handles funds or other property of such a plan shall be bonded.” This is a broad definition, and it applies to both retirement plans (like 401(k)s and pension plans) and many funded health and welfare plans. Let’s unpack it a bit.

Essentially, if an individual has a role that involves access to plan assets or the authority to make decisions that could lead to a loss of those assets through fraud or dishonesty, they likely need to be bonded. The Department of Labor specifies that this typically includes the plan administrator and those officers and employees of the plan or plan sponsor (like your company or a joint board) whose duties involve the receipt, safekeeping, and disbursement of funds. This applies whether the funds are for retirement benefits or for health and welfare benefits, such as medical, dental, or life insurance plans, provided they are subject to ERISA and handle funds.

But it doesn’t stop there. The bonding requirement can also extend to service providers to the plan, such as third-party administrators (TPAs) who might process claims for a health plan, or investment advisors for a pension plan, if their employees handle plan funds or property. The U.S. Department of Labor (DOL) explains that “handling” is broadly defined. According to 29 C.F.R. § 2580.412-6, handling includes not only physical contact with funds or other property, but also the power to exercise control or direction over funds or other property. This can include having the power to transfer funds or negotiate plan property, disbursement authority, the authority to sign checks, or even supervisory or decision-making responsibility over these activities. So, it’s not just about who touches the money, but also who has the power to control or direct it, regardless of whether it’s pension assets or contributions for a welfare plan.

The U.S. Department of Labor guidance also clarifies that fiduciaries, who owe duties of good faith and trust to plan members, are central to this requirement if they handle plan funds or other property. This includes plan administrators, trustees, and even plan sponsors (the employers offering the plans) if they perform handling functions.

However, there are important exceptions, particularly relevant for some health and welfare plans. The U.S. Department of Labor, in its Field Assistance Bulletin 2008-04 (FAB 2008-04), clarifies that plans that are completely “unfunded” are exempt from bonding requirements. An unfunded plan is one where benefits are paid only from the general assets of the employer or union, and these assets are not segregated in any way until benefits are distributed. If a health and welfare plan operates this way, it might be exempt. Conversely, a plan is generally not considered unfunded (and thus likely requires bonding if funds are handled) if:

- Any benefits are provided or underwritten by an insurance carrier (though the insurance company itself might be exempt).

- There is a trust or other separate entity (like a VEBA trust for a welfare plan) to which contributions are made or out of which benefits are paid.

- Contributions to the plan are made by employees (e.g., through payroll deductions for health insurance premiums), or from any source other than the employer or union involved. The DOL notes that plans receiving employee contributions are generally not considered unfunded.

- There is a separately maintained bank account or other evidence of a segregated fund for the plan.

An interesting point from FAB 2008-04 (Q&A 13) is that the DOL, as an enforcement policy, treats employee welfare benefit plans associated with a Section 125 cafeteria plan as unfunded for bonding purposes if they meet the requirements of DOL Technical Release 92-01, even if they include employee contributions. Additionally, certain regulated financial institutions like specific banks and insurance companies might also be exempt under specific conditions. Given these nuances, especially for health and welfare plans, it’s always best to review the specifics of your plan and consult with an ERISA expert if you’re unsure, as the responsibility for ensuring proper bonding falls on everyone involved in handling plan funds.

ERISA Bond Coverage: What's Included and What's Not

Understanding the scope of an ERISA bond is vital for plan sponsors and fiduciaries. It’s not a catch-all insurance policy, but rather a specific protection against certain types of losses. Let’s break down what an ERISA bond typically covers and, just as importantly, what it doesn’t.

What Does an ERISA Bond Cover?

An ERISA bond is laser-focused on protecting the plan from losses due to acts of fraud or dishonesty committed by individuals who “handle” plan funds or other property. The U.S. Department of Labor is very clear on this: the bond covers losses stemming from actions such as larceny, theft, embezzlement, forgery, misappropriation, wrongful abstraction, wrongful conversion, and willful misapplication. Essentially, if someone with access to plan assets intentionally steals or misuses them, the ERISA bond is there to help the plan recover those financial losses.

The U.S. Department of Labor guidance clarifies that the bond covers these illegal acts when perpetrated by anyone serving in a fiduciary capacity or anyone else who handles the plan’s funds. This could include plan administrators, trustees, or even certain employees of the plan sponsor if their duties involve access to plan assets. The DOL also states that the bond offers indemnification up to the coverage maximum if someone in a fiduciary position embezzles or steals from the plan. It’s designed to make the plan whole again after such an unfortunate event.

What Does an ERISA Bond NOT Cover?

It’s equally crucial to understand the limitations of an ERISA bond. This bond does not cover losses resulting from poor investment decisions, market downturns, or general mismanagement, unless those actions also involve fraud or dishonesty. For instance, if a fiduciary makes an imprudent investment that loses money but did so without any intent to deceive or steal, the ERISA bond would not apply.

Furthermore, as the U.S. Department of Labor points out in its Field Assistance Bulletin No. 2008-04, an ERISA bond is distinct from fiduciary liability insurance. Fiduciary liability insurance is designed to protect fiduciaries (and sometimes the plan itself) against claims of breach of fiduciary duties, such as negligence, errors, or omissions in managing the plan. An ERISA bond, on the other hand, is strictly for losses due to dishonest acts. The DOL guidance also notes that the ERISA bond does not insure anyone against legal charges or liabilities for the crimes they may have committed; its purpose is solely to replace the lost funds in the employee benefit plan. The Society for Human Resource Management (SHRM) also highlights in its fiduciary obligations guidance that commercial crime insurance, while covering an organization’s own property from crime, is not a direct substitute for an ERISA bond, as the latter is specifically structured to meet ERISA’s regulatory requirements for employee benefit plans.

Why ERISA Bonds Are Necessary

The necessity of ERISA bonds stems directly from the core mission of the Employee Retirement Income Security Act of 1974: to protect the interests of participants in employee benefit plans and their beneficiaries. Before ERISA, instances of mismanagement and abuse of pension funds were unfortunately not uncommon, leaving employees vulnerable to losing their anticipated retirement income. The U.S. Department of Labor highlights that ERISA was enacted to address these public concerns. A key component of this protection is the fidelity bond requirement.

Why is this bond so crucial? Imagine a scenario where an individual entrusted with managing a company’s 401(k) plan funds decides to illicitly divert some of those assets for personal gain. Without an ERISA bond, the plan participants could suffer significant financial losses, potentially jeopardizing their retirement security. The ERISA bond acts as a financial safeguard, ensuring that if such dishonest acts occur, the plan can be reimbursed for the stolen or misappropriated funds. The U.S. Department of Labor (DOL) guidance explains that ERISA formalized and substantially increased the potential liabilities of plan fiduciaries, and the bond requirement is a direct consequence, ensuring a mechanism for recovery in cases of fraud or dishonesty. Essentially, ERISA bonds are necessary to build and maintain trust in private-sector retirement plans as well as health and welfare benefit plans by providing a crucial layer of financial security against internal wrongdoing.

ERISA Bond Requirements - What the Law Says

Navigating the legal requirements for ERISA bonds is essential for compliance and for ensuring your employee benefit plan is adequately protected. ERISA, specifically Section 412, lays out the ground rules, and the U.S. Department of Labor provides ongoing guidance. Let’s delve into what the law stipulates.

First and foremost, the law mandates the amount of coverage. Generally, each person who handles plan funds or property must be bonded for at least 10% of the amount of funds they handled in the preceding year. The U.S. Department of Labor clarifies this with an important detail: the bond amount cannot be less than $1,000. There’s also a ceiling: the Department cannot require a plan official to be bonded for more than $500,000. However, there’s a notable exception: for plans that hold employer securities, this maximum bond amount increases to $1,000,000. The U.S. Department of Labor’s guidance reiterates these specific figures, emphasizing their importance in determining adequate coverage.

It’s also crucial to understand that these amounts apply per plan. If a bond covers multiple plans, or if individuals handle funds for more than one plan, the total bond amount might need to be higher to satisfy the 10% rule for each plan involved.

Another key legal requirement, highlighted by the U.S. Department of Labor (see 29 C.F.R. § 2580.412-11), is that ERISA fidelity bonds cannot have a deductible for losses that fall within the required bonding amount. This means the bond must cover losses from the very first dollar, up to the bonded amount. This ensures that the plan doesn’t have to absorb initial losses before the bond kicks in.

Where can you get an ERISA bond? The law is specific here too. Bonds must be obtained from a surety or reinsurer that is named on the Department of the Treasury’s Listing of Approved Sureties (Department Circular 570). Under certain conditions, bonds from Underwriters at Lloyds of London may also be acceptable. The Department of Labor stresses that neither the plan nor any interested party can have significant financial control or interest in the surety, reinsurer, agent, or broker through which the bond is obtained. This rule is in place to prevent conflicts of interest.

Finally, the type of bond is also regulated. The U.S. Department of Labor guidance (e.g., 29 C.F.R. § 2580.412-10) indicates that the bond must be in a form or forms approved by the Secretary of Labor, which can include individual bonds (covering one person), schedule bonds (covering a list of named individuals or positions), or blanket bonds (covering all employees or positions that handle funds). The choice often depends on the plan’s structure and the number of people requiring coverage. Staying informed about these legal requirements is not just about compliance; it’s about upholding the fiduciary responsibility to protect plan assets diligently.

How ERISA Bonds Work

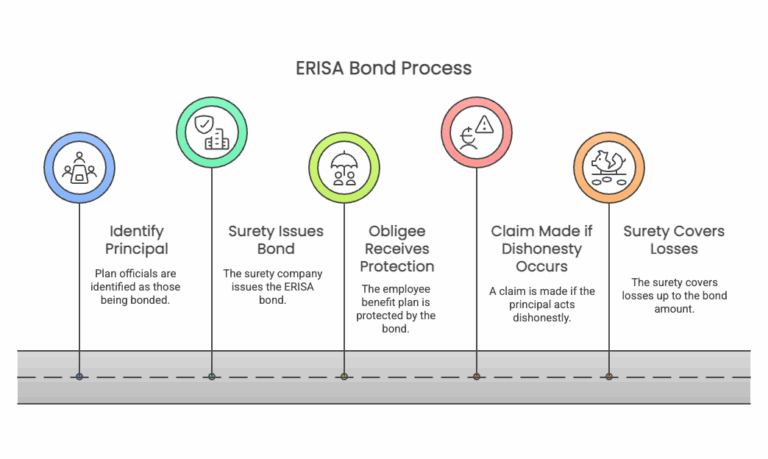

Understanding how an ERISA bond functions can seem a bit like navigating a specialized insurance contract, and in many ways, it is. At its heart, an ERISA bond is a three-party agreement designed to protect the assets of an employee benefit plan. Let’s break down the roles and the process in a way that’s easy to grasp.

The U.S. Department of Labor (DOL) guidance, specifically in Field Assistance Bulletin 2008-04 (Q&A 3), explains this structure. In a typical bond:

- The Principal: These are the plan officials, the individuals who are being bonded – typically, the plan fiduciaries and anyone else who “handles” the plan’s funds or other property. They are the ones whose honesty and faithful performance of duties related to plan assets are being guaranteed.

- The Surety (or Insurer): This is the bonding or insurance company that issues the ERISA bond, which must be a surety named on the Department of the Treasury’s Listing of Approved Sureties. The surety guarantees to the plan (the obligee) that it will cover losses up to the bond amount if the principal acts dishonestly (e.g., commits fraud or theft).

- The Obligee: This is the employee benefit plan itself. The plan is the entity that is insured and protected by the bond. If the plan suffers a financial loss due to the fraudulent or dishonest actions of a bonded individual, the plan can make a claim to the surety for reimbursement.

So, how does it work in practice? If a person covered by the bond (the principal) engages in an act of fraud or dishonesty that causes a financial loss to the plan (the obligee), the plan can file a claim against the bond with the surety company. The U.S. Department of Labor emphasizes that the plan is the named insured party on the bond, allowing it to recover losses covered by the bond. The surety will then investigate the claim. If the claim is valid and covered under the terms of the bond, the surety will pay the plan for the losses, up to the maximum amount specified in the bond.

It’s important to remember, as the U.S. Department of Labor guidance implies, that the ERISA bond exists to replace lost funds within the plan. It doesn’t protect the individuals who committed the dishonest acts from legal consequences or other liabilities. The primary goal is to make the plan whole and protect the benefits promised to participants and beneficiaries. The bond essentially acts as a financial backstop, ensuring that the plan’s assets are shielded from specific types of internal criminal behavior.

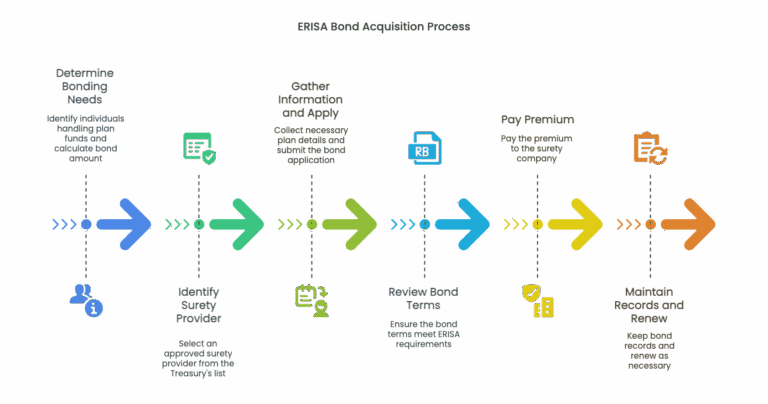

Steps to Acquire an ERISA Bond

Obtaining an ERISA bond might seem like a complex administrative task, but breaking it down into manageable steps can simplify the process. While the specifics can vary slightly depending on the surety provider, here’s a general roadmap to help you navigate acquiring the necessary coverage for your employee benefit plan.

- Determine Who Needs to Be Bonded and the Required Amount:

- As we’ve discussed, the first crucial step is identifying every individual who “handles” plan funds or other property. This includes fiduciaries, plan administrators, trustees, and any employees or even third-party service providers with access or control over plan assets. (Source: U.S. Department of Labor, The Hartford)

- Next, calculate the required bond amount for each person, or for the plan as a whole if using a blanket bond. This is generally 10% of the funds handled in the previous year, with a minimum of $1,000 and a maximum of $500,000 (or $1,000,000 for plans with employer securities). This calculation should be done at the beginning of each plan year. (Source: U.S. Department of Labor, Insurance Training Center)

- Identify an Approved Surety Provider:

- ERISA mandates that bonds must be obtained from a surety or reinsurer named on the U.S. Department of the Treasury’s Listing of Approved Sureties (Department Circular 570). You can typically find this list online or consult with an insurance broker who specializes in ERISA bonds. (Source: U.S. Department of Labor, Insurance Training Center)

- Ensure that neither the plan nor any interested party has a significant financial interest or control in the chosen surety, agent, or broker to avoid conflicts of interest. (Source: U.S. Department of Labor)

- Gather Necessary Information and Apply for the Bond:

- The surety provider will require specific information about your plan and the individuals to be bonded. This often includes:

- The plan name and details (e.g., type of plan, number of participants).

- The total amount of plan assets handled.

- Information about the individuals needing coverage (names, positions).

- Details about the plan’s internal financial controls.

- You’ll need to complete an application provided by the surety. Be thorough and accurate in your responses, as this information will be used to underwrite the bond and determine the premium.

- The surety provider will require specific information about your plan and the individuals to be bonded. This often includes:

- Review the Bond Terms and Pay the Premium:

- Once the application is processed and approved, the surety will issue a bond proposal. Carefully review all the terms and conditions, ensuring the coverage amount is correct, the plan is named as the insured (the obligee), and it meets all ERISA requirements (e.g., no deductibles for the required amount). (Source: U.S. Department of Labor)

- If everything is in order, you will pay the premium to the surety company. The cost of the bond can typically be paid from plan assets, as its purpose is to protect the plan. (Source: U.S. Department of Labor)

- Maintain Records and Renew as Necessary:

- Keep a copy of the ERISA bond with your plan records. You may need to provide evidence of bonding to the Department of Labor or plan auditors.

- ERISA bonds are typically issued for a specific term (e.g., one year or three years). Be sure to track the renewal date and reassess your bonding needs annually to ensure continued compliance, especially as plan assets or the individuals handling funds may change.

While these steps provide a general guide, working with an experienced insurance broker or a surety company familiar with ERISA requirements can make the process smoother and help ensure you obtain the correct coverage for your plan. They can often assist with the application process and answer any specific questions you might have.

Frequently Asked Questions (FAQs)

Is an ERISA Bond Required by Law?

Yes, absolutely. The Employee Retirement Income Security Act (ERISA) of 1974, specifically Section 412, mandates that fiduciaries and individuals who handle funds or other property of an employee benefit plan must be bonded. The U.S. Department of Labor is unequivocal on this: it is an unlawful act for any person to handle plan funds or property without being properly bonded, unless they fall under a specific exemption. This legal requirement is a cornerstone of ERISA’s protections for plan participants.

Is an ERISA Bond Required for All 401(k) Plans?

Generally, yes. Most 401(k) plans are subject to ERISA and its bonding requirements because they involve individuals handling plan assets (employee and employer contributions, investment funds, etc.). As long as the 401(k) plan is covered by Title I of ERISA and is not one of the specifically exempted types of plans (like a completely unfunded plan, a governmental plan, or a church plan), then the individuals handling its funds must be bonded. The U.S. Department of Labor confirms that the bonding requirements generally apply to most ERISA retirement plans.

Are ERISA Bonds Required for Health and Welfare Plans?

Yes, ERISA bonding requirements generally apply to many funded health and welfare plans (e.g., medical, dental, disability, life insurance plans) that are subject to ERISA, just as they do for retirement plans. If individuals handle funds or other property of such a plan, they must be bonded. The key determining factor, as clarified by the U.S. Department of Labor (including in FAB 2008-04), is whether the plan is “funded.” A health and welfare plan is typically considered funded (and thus subject to bonding if funds are handled) if it has a trust, a separate bank account, or if employee contributions are segregated or handled by the plan. However, completely unfunded plans, where benefits are paid directly from the employer’s general assets, are exempt.

Additionally, the DOL has an enforcement policy that treats welfare plans funded solely through a Section 125 cafeteria plan as unfunded for bonding purposes if they meet specific criteria (DOL Technical Release 92-01). Given the complexities, especially around what constitutes “handling funds” and whether a plan is truly “unfunded,” it is crucial for sponsors of health and welfare plans to carefully evaluate their specific arrangements.

Fiduciary Liability vs. ERISA Bond - What’s the Difference?

This is a very common point of confusion, but the distinction is critical.

- ERISA Fidelity Bond: As explained by the U.S. Department of Labor and The Hartford, an ERISA bond protects the plan from losses due to fraud or dishonesty (e.g., theft, embezzlement) by those who handle plan funds. It’s about intentional criminal acts.

- Fiduciary Liability Insurance: This type of insurance, as detailed by the Insurance Training Center and The Hartford, protects the fiduciaries (and sometimes the plan) from claims related to breaches of their fiduciary duties. This typically covers mismanagement, negligence, errors, or omissions in their responsibilities that cause financial harm to the plan. It’s more about mistakes or poor judgment rather than intentional theft.

In short: ERISA bonds cover crime; fiduciary liability insurance covers mismanagement. An ERISA bond is legally required; fiduciary liability insurance is generally optional but highly recommended for fiduciaries.

How Do I Calculate the Correct ERISA Bond Amount?

Calculating the correct ERISA bond amount is a key compliance step. The U.S. Department of Labor, The Hartford, and the Insurance Training Center all provide consistent guidance:

- Base Amount: Each person handling plan funds must generally be bonded for at least 10% of the amount of funds they handled in the preceding plan year.

- Minimum Bond: The bond amount cannot be less than $1,000 per plan.

- Maximum Bond (General): The Department of Labor cannot require a plan official to be bonded for more than $500,000 per plan.

- Maximum Bond (Plans with Employer Securities): If the plan holds employer securities, the maximum required bond amount increases to $1,000,000 per plan.

It’s important to perform this calculation at the beginning of each plan year, as the amount of funds handled can change. If a single bond covers multiple individuals or multiple plans, the total bond amount must be sufficient to meet the 10% requirement for each person and each plan covered.

Conclusion: Securing Trust with ERISA Bonds

Understanding and implementing ERISA bond requirements is more than just a regulatory hurdle; it’s a fundamental aspect of responsible plan stewardship and a testament to an organization’s commitment to its employees’ financial well-being. As we’ve explored, an ERISA bond serves as a critical financial shield, protecting employee benefit plans from the potentially devastating impact of fraud and dishonesty. From grasping what an ERISA bond is and why it’s mandated by federal law, to identifying who needs coverage, understanding the specific legal requirements, and knowing how these bonds function, every piece of knowledge empowers plan sponsors and fiduciaries to act in the best interests of plan participants.

The journey to securing an ERISA bond involves careful calculation of coverage amounts, selection of an approved surety, and diligent adherence to the rules set forth by the Department of Labor. While distinct from fiduciary liability insurance, which addresses mismanagement, the ERISA bond specifically targets criminal acts, ensuring that the plan itself can recover losses from theft or embezzlement. By ensuring your plan has the correct ERISA fidelity bond in place, you are not only complying with the law but also reinforcing the trust that your employees place in their retirement and benefit programs. It’s a vital component in the ecosystem of safeguards designed to protect the future financial security of hardworking individuals across the nation.

References

- U.S. Department of Labor. (n.d. ). Protect Your Employee Benefit Plan With an ERISA Fidelity Bond. Retrieved from https://www.dol.gov/sites/dolgov/files/ebsa/about-ebsa/our-activities/resource-center/publications/protect-your-employee-benefit-plan-with-an-erisa-fidelity-bond.pdf

- U.S. Department of Labor, Employee Benefits Security Administration. (2008, November 25). Field Assistance Bulletin No. 2008-04: Guidance Regarding ERISA Fidelity Bonding Requirements. Retrieved from https://www.dol.gov/agencies/ebsa/employers-and-advisers/guidance/field-assistance-bulletins/2008-04

- Society for Human Resource Management (SHRM). (n.d.). What You Need to Know about Retirement Plan Fiduciary Obligations & Risk Management. Retrieved from https://www.shrm.org/content/dam/en/shrm/business-solutions/Whitepaper-Retirement-Plan-Fiduciary-Obligations-and-Risk-Management.pdf

- Code of Federal Regulations, Title 29 (29 C.F.R.) Part 2580 – Bonding Requirements. (e.g., https://www.ecfr.gov/current/title-29/subtitle-B/chapter-XXV/subchapter-I/part-2580)

- Code of Federal Regulations, Title 29 (29 C.F.R.) § 2550.412-1 – Bonding requirements. (e.g., https://www.ecfr.gov/current/title-29/subtitle-B/chapter-XXV/subchapter-F/part-2550/section-2550.412-1)